How to Invest During Chaotic Times

February 28, 2022

By Samuel Richter

By Samuel Richter

Securities AnalystThe S&P 500 entered correction territory last Tuesday, a decline of more than 10 percent from its record high on Jan. 3. As discussed in previous commentaries, the markets are pricing in the anticipated interest rate hikes from the Federal Reserve.

A second contributor is the expanding war between Russia and Ukraine — which is not only a humanitarian tragedy, but also a conflict that will continue to impact the markets.

Now more than ever, the volatile start to the year shows the importance of diversification.

Why diversification is so important

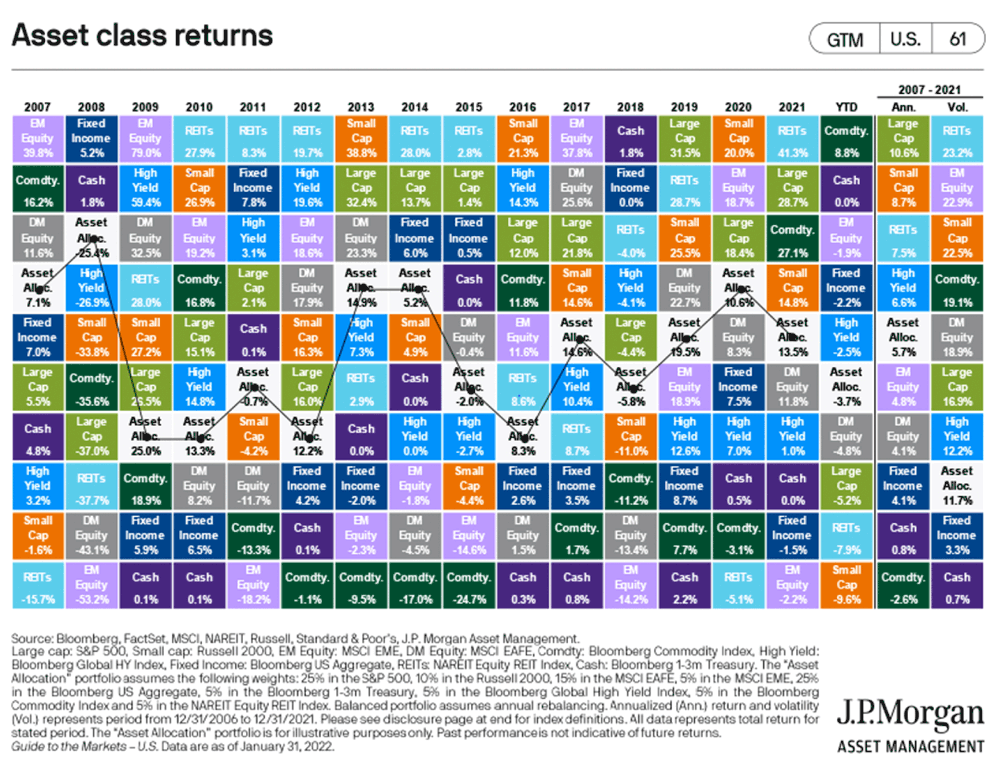

Portfolios with broad diversification have outperformed in this volatile time. The chart below from J.P. Morgan’s Guide to the Markets shows asset class returns throughout the years. Each asset class has its own color. The constant change in colors from year to year shows how market leadership changes from year to year. The broadly diversified portfolio (white box) provides a favorable long-term return while smoothing out the volatile swings.

Valuing value over growth

The S&P 500 is a capitalization-weighted index, meaning the largest companies carry the most weight. In fact, the top 10 components account for just over 28% of the entire index value. Those heavily weighted stocks are mostly growth-themed technology names. They have declined about 4% more than the entire S&P 500, on average.

If you take out the two value names in the top 10, then the remaining eight growth-oriented stocks make up just over 25% of the index. Those eight stocks on average have declined about 6% more than the total S&P 500 this year. This shows the impact growth-oriented stocks have on performance of the S&P 500.

This is why we build our client portfolios to protect value in this volatile, higher-inflation, rising-interest-rate environment. On the stock side, we are fully diversified with a slight tilt toward value-oriented and foreign themes. Those areas of the market tend to ‘hold their own’ better in a rising interest rate environment.

What about bonds?

On the bond side, we have reduced duration in order to better preserve principal in a less investor friendly interest rate environment. Our positioning has helped performance in the challenging beginning of 2022.

Sometimes there are few places to hide, but our positioning is lowering the impact of the ‘bad news’ our clients are seeing in the headlines. We work to provide the best opportunity to meet your long-term goals with the minimal amount of short-term risk. Diversification is a core tenet of this philosophy.

Contact us today to discuss how your portfolio is set up to achieve your long-term goals. As always, your success – and safety – matter to us.

Image: What appears to be an armed soldier, wearing the Ukrainian colors, poses or a photograph. Credit: iStock/Getty Images