Dollar Dips, World Gains: The Power of Global Perspective

October 6, 2025

By Eric Johnson

By Eric Johnson

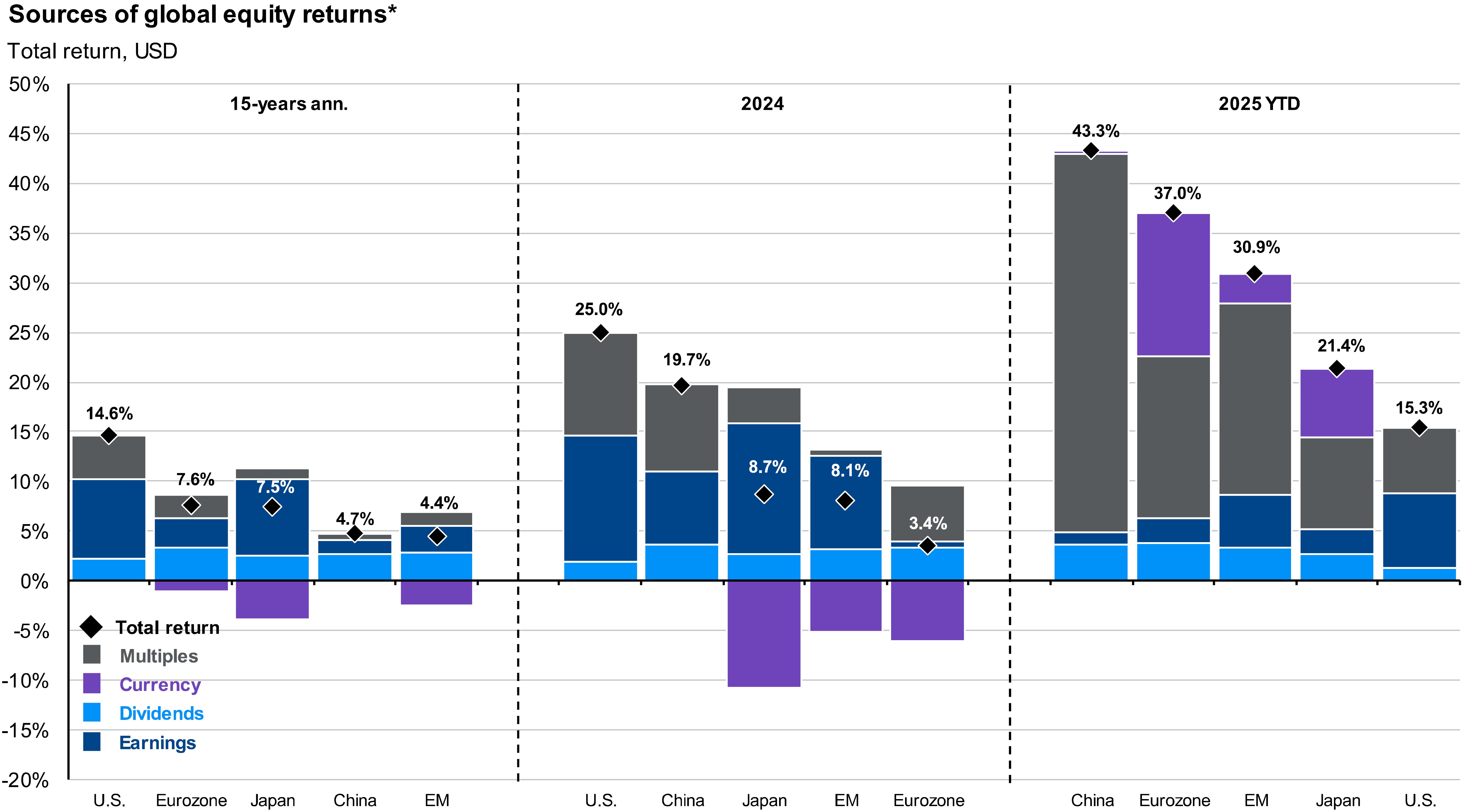

Securities AnalystIt is a good time to revisit my January commentary on U.S. exceptionalism now that we are three quarters through 2025. As a refresher, at the start of the year, many expected U.S. stocks to outpace international markets, citing stronger consumer spending and higher corporate profitability. While those trends remain intact, U.S. exceptionalism has not played out as anticipated. In fact, international stocks (MSCI All-Country World Index ex-U.S.) are on pace to outperform domestic stocks (S&P 500) this year. This has only happened three other times since 2010. If we examine year-to-date sources of global equity returns, as illustrated below, the clear drivers of international outperformance are multiples (the grey bars) and currency (the purple bars).

Source: J.P. Morgan, Guide to the Markets

Multiples

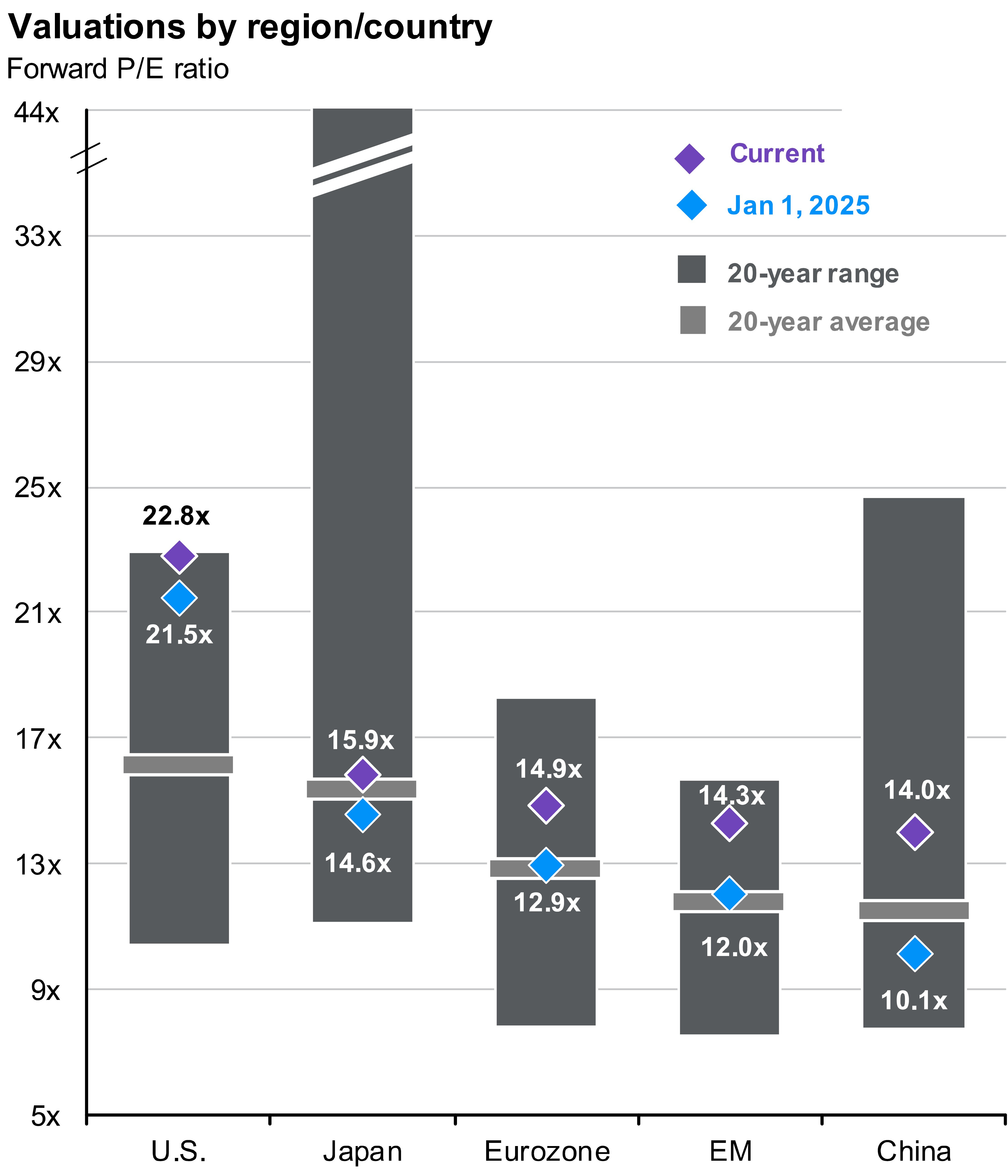

In this case, multiples refer to forward P/E (Price-to-Earnings) ratios, a valuation metric used to determine if a stock is priced attractively. As evident with the chart below, U.S. stocks started the year with higher valuations, making international stocks look relatively “cheap” to investors. Cheap valuations, combined with regional tailwinds, have supported gains abroad. This is due to corporate reforms in Japan aimed at prioritizing shareholder returns, NATO members’ increased military and infrastructure spending in wake of the Russia-Ukraine war, Taiwan’s semiconductor leadership in the AI boom, and Chinese stimulus through lower lending rates and AI enthusiasm. While the valuation gap has narrowed between the U.S. and the rest of the world, it remains historically wide.

Source: J.P. Morgan, Guide to the Markets

Currency

Along with multiple expansion, currency movements have added to the international advantage. The U.S. dollar, measured by the DXY Index shown below, is down -9.8% year-to-date. Generally speaking, you must use the local currency to buy a foreign stock. For instance, a U.S. investor would need to convert their dollars to yen to buy a Japanese stock. If the value of the dollar were to weaken against the yen, the Japanese stock’s return would appear higher than if the currency values would have remained unchanged. The dollar’s decline this year reflects both cyclical forces, after nearly 15 straight years of appreciation, and investor concerns over U.S. trade policy.

Source: FactSet

Overconfidence in U.S. stocks led many investors to miss out on international’s outperformance. Predicting which region, sector, or stock will lead in any given year is challenging to do. This year is a prime example. That is why we emphasize diversification and value-based investing over chasing fads. To learn more about our investment approach, contact us today. Your success matters.