What Really Drives Economic Growth?

August 2, 2021

By Michael List, CFP®

By Michael List, CFP®

Portfolio Manager

Paul Samuelson once famously said the stock market had predicted nine of the last five recessions.

This comes to mind after reading Krista’s comments last week, when the National Bureau of Economic Research declared [in July 2021] that the recession officially ended April 2020. Economists must be the only group to have successfully predicted the last seven recessions — many months after the fact.

All “predictions” aside, you might be wondering: what really causes a recession to end (and an economy to grow)? Let's take a look at two main factors:

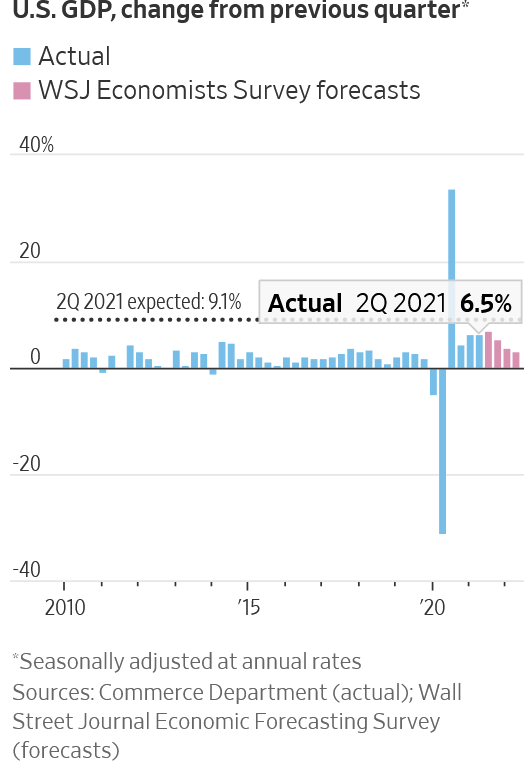

1) U.S. GDP Growth

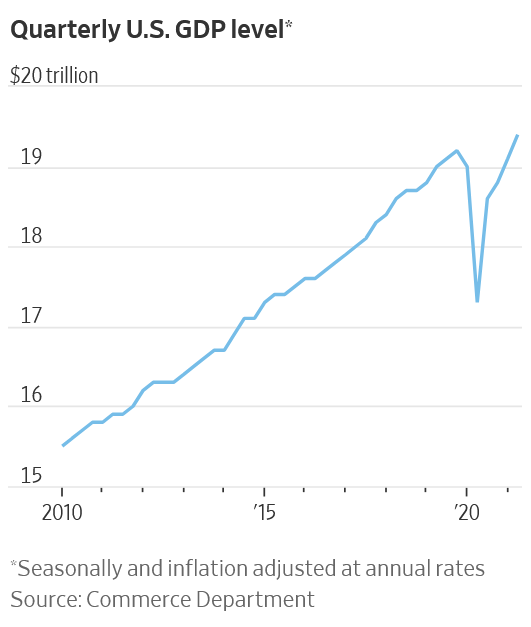

In all fairness, economists didn't know U.S. GDP growth for the second quarter until July. According to a WSJ Economic Forecasting Survey, economists expected an annual growth rate of 9.1%, but the actual data from the Commerce Department reported a growth rate of 6.5%. We’ll go easy on the economists; to quote another great, Yogi Berra, “It’s tough to make predictions, especially about the future.” Economists were ‘directionally’ correct, and with another annualized gain over six percent, the past several quarters have been the fastest stretch of growth in over a decade. The recovery was also fast enough to push U.S. GDP above the pre-pandemic level.

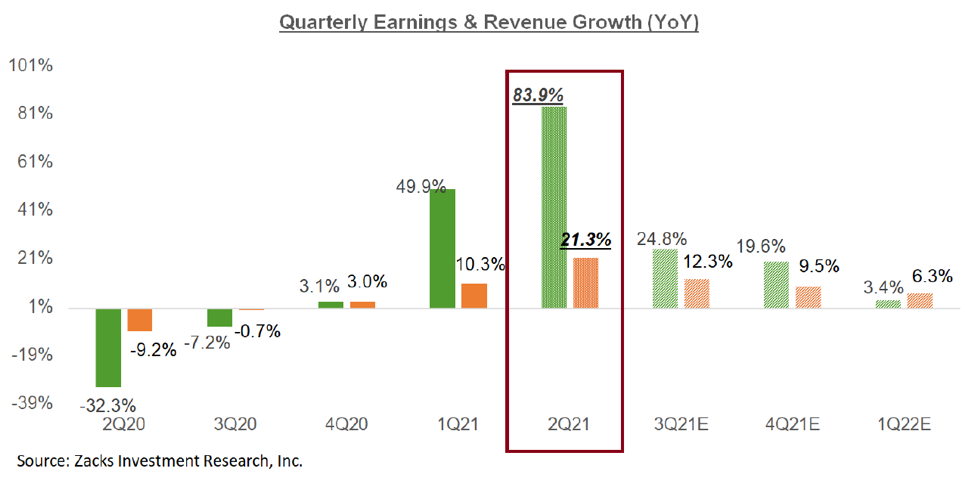

2) Corporate Earnings

Related to economic growth, but often lagging, is corporate revenue and earnings. Company earnings have been in an upswing recently and we are likely to see peak growth in the second quarter. We are about halfway through the quarterly earnings season, and analysts expect earnings for S&P 500 companies to grow 84% from a year ago. Some of that growth is due to the ‘base effect’ (we discussed the base effect impact on inflation in past commentary last month). A year ago, earnings fell 32% — meaning just to get back to where they started, earnings had to grow 47%. Fortunately, they have done that and more, leading to record quarterly earnings for the S&P 500. When the stock market is at an all-time high, it’s good to have earnings at record levels, too. Earnings and GDP have both exceeded pre-pandemic highs this year.

Looking Forward

Earnings and GDP growth rates will slow in the coming quarters. Even if the predictions miss the mark, they should be ‘directionally’ correct and the growth rates in the second half of 2021 will be higher than the average over the past decade. This provides a helpful environment for stocks as we move into the remainder of the year. If you would like to discuss your performance or our outlook, please reach out to your wealth management advisor.