What a tree can teach us about investing

July 25, 2022

By Tim Hayes

By Tim Hayes

Investments InternWarren Buffet once said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.” Most trees usually take several years to fully develop, and the same can be said when investing. Millionaires are not made overnight in the stock market. However, patience, persistence and careful guidance can lead you toward success.

Patience is Key

It is intrinsic human behavior to worry and become weary when placed in a difficult situation. For those participating in today’s economic climate, this may seem true. It has been a tough first half of the year with the ongoing bear market, inflation and rising interest rates. In fact, we may become a little impatient and desire immediate results of improvement.

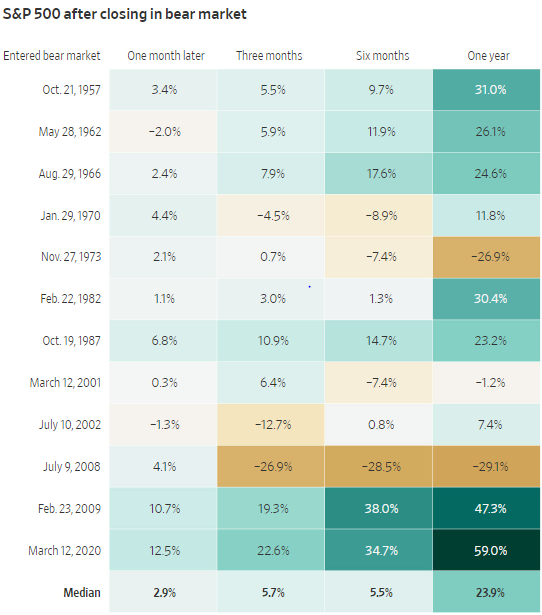

Remember, patience is the name of the game and let time be your best friend. History tells us that improved conditions are waiting on the horizon. The chart below reveals how persevering through a bear market leads to great potential returns:

Source: Wall Street Journal

Where are we today?

It has been a busy couple of weeks with a plethora of economic data. The Consumer Price Index (CPI) rose to 9.1% in June on a year-over-year basis. Furthermore, the Producer Price Index (PPI) rose to a near-record high of 11.3% in June. Investors eye these economic indicators as they try to address the health of the economy.

Moreover, we are living in one of the strongest labor markets in our nation’s history. In June, 372,000 jobs were added while jobless claims still remain near historic lows.

These mixed economic signals give Jerome Powell and the Federal Reserve the go-ahead to continue to combat inflation by raising interest rates. These economic measures all but assure the Fed will move by 75 basis points at their July meeting, with 100 basis points a growing possibility.

What matters most

Investing in the current economic climate may seem daunting or maybe even a little ambivalent. It is almost like a tree trying to grow in arid soil—there doesn’t seem to be much progress. However, just as the weather changes, the economy will also change. That tree will not grow overnight, nor will it mature in only a few years.

The same can be said with macroeconomic activity and investing. The first few years may seem to be stagnant, but it is with time that you will be able to bear the fruits of your investments. Contact an advisor today and let us know how we can help.