Haunted By Market Fear? Here’s How To Respond

October 27, 2025

By Michael List, CFA, CFP®

By Michael List, CFA, CFP®

Investment Management OfficerIf you’ve been putting it off, the time to act is NOW. This week might be your last chance to enjoy horror movies or haunted houses before the season ends. Fear is one of our oldest emotions. It triggers strong reactions in both our body and mind, preparing us to act. That action isn’t always logical—it’s meant to keep us alive. Because of that, fear can be both motivating and misleading.

In moments of danger, quick action pays off. When we’re afraid, our “animal brain” often takes over while our “thinking brain” steps back. If a lion charges two people, the one who runs or grabs a stick has a better chance of surviving than the one who pauses to analyze. Planning and strategy help in the long run, but not when danger is immediate.

We see the same instincts in investing. Fear of the unknown drives us to save for emergencies. Fear of loss makes us cautious about taking risk. Fear of missing out (FOMO) can push us to invest too quickly or reach too far.

The Surge of ETFs

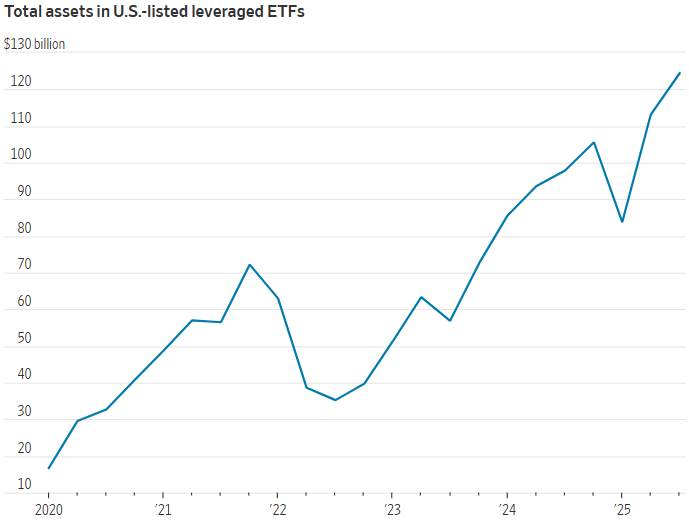

Over the past 15 years, the U.S. stock market has produced some of the strongest returns in a century. With new technology trends emerging, it’s easy to feel FOMO right now. One area seeing huge growth is leveraged exchange-traded funds (ETFs). Assets in these funds have surged nearly 800% in the past five years. Leverage lets investors borrow money to amplify returns—something that can seem tempting when trying to “catch up.”

Source: WSJ; Morningstar

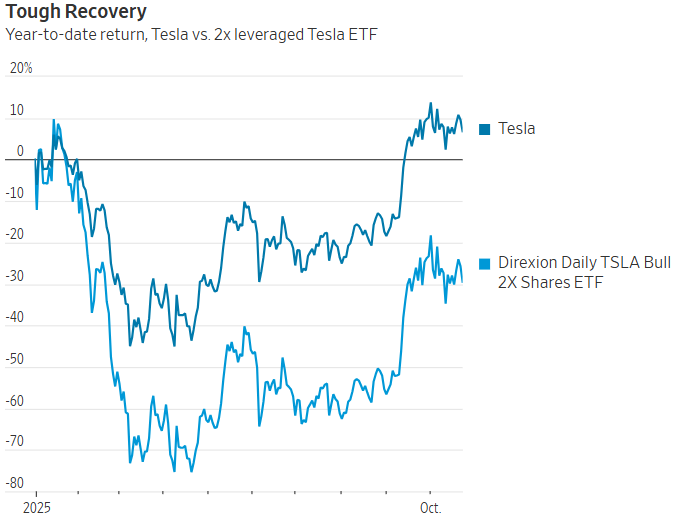

However, leveraged ETFs don’t always perform as investors hope. Take the 2x leveraged Tesla ETF, designed to deliver twice Tesla’s daily returns. Tesla’s stock is up 11% this year, but the 2x ETF is actually down 22%. Why?

- The fund targets daily returns, not long-term performance.

- Leverage multiplies both gains and losses.

- Recovering from losses takes bigger gains—a 20% drop requires a 25% rebound to break even.

When Tesla fell 40% earlier this year, the leveraged fund fell about 75%. Tesla’s stock needed a 67% rebound to recover while leveraged fund would need a 300% gain.

Source: WSJ; Factset

Fear—whether it’s of losing money or missing out—should be respected and managed. Like haunted houses, the market can make us feel danger even when we’re not in real peril. Most risks aren’t immediate, giving investors time to plan instead of reacting to every new investment product. Financial planning software allows us to test the plan for various risks and see the potential impact on your goals. If you would like to review your financial plan or have concerns about market risks, reach out to your advisor today. Your financial success matters to us.