Are You Investing? Here's an Important Bias to Recognize

June 6, 2022

By Samuel Richter

By Samuel Richter

Securities AnalystIt has been a challenging year for many investors. Downturns in the market make for uncomfortable times, but it is important to remain disciplined and focused on the long term.

In times of heightened volatility, investors may make decisions that do not align with their long-term investment strategy. Be cautious not to fall into the trap of recency bias when making decisions.

How to avoid recency bias in your investments:

Recent poor performance may cause an investor to conclude that the market will continue to fall for an extended period. This may lead to selling out of the market rather than remaining disciplined.

It is important to remember that markets do not move in a straight line. This is not the first or last time we will see a market downturn. If you sell out now and “wait for a better time to invest” then you are trying to time the market. My colleague Jonathan Smith discussed this in his recent article, Time in the Market vs. Timing the Market.

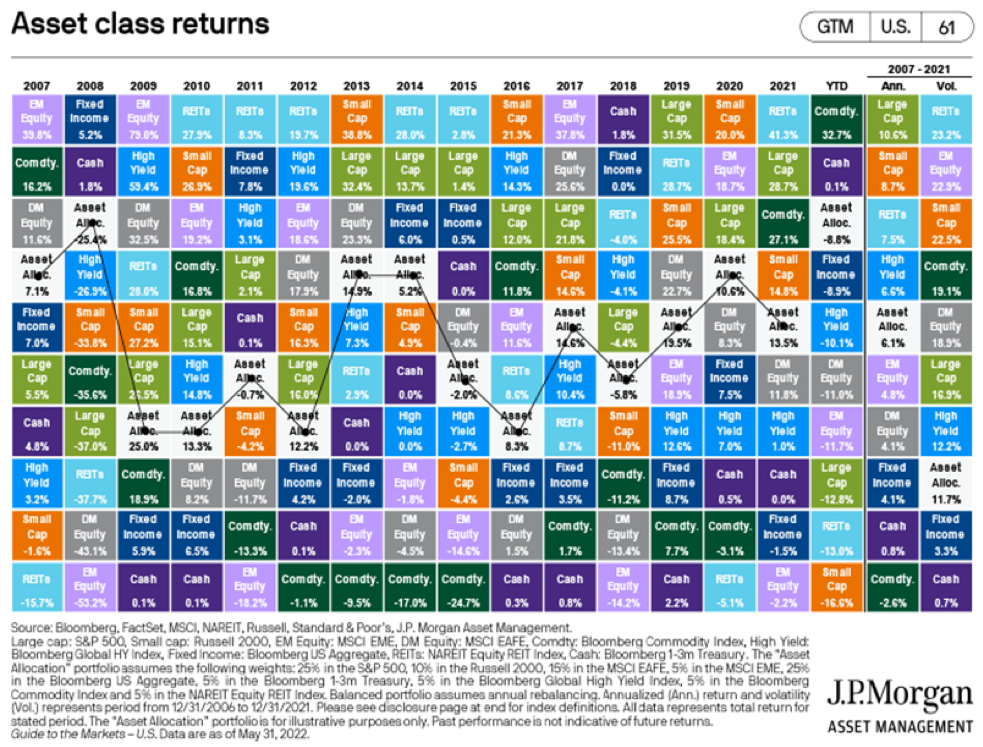

Conversely, recency bias can cause investors to chase returns by investing heavily in what has done well recently. Rather than remain fully diversified, an investor might invest more heavily in commodities because that is the top performing sector this year.

Chasing returns is not a viable investment strategy as market leadership changes over time. This is illustrated in the chart below.

It is important to remain disciplined in times of discomfort and heightened volatility. Our task is to build and manage your portfolio to provide the best opportunities to meet your long-term goals with minimal amount of short-term risk.

Remaining invested and diversified are core tenets of our investment philosophy. Contact us today to discuss how your long-term investment strategy can help you reach your goals.