How to Stay Ahead of Inflation in Your Investments

June 8, 2020

By Tom Limoges

By Tom Limoges

Asst. VP - Investments Growing up, I spent many weekends in the summertime traveling with my grandparents. They loved to go for drives, camp locally in their travel trailer, and vacation around the country. My grandmother, who grew up during the Great Depression and World War II, was naturally a saver, frugal and risk averse. Sitting around her kitchen table when I was a kid, I'd often hear her say how much more expensive things were as compared to when she was growing up. This was my introduction to inflation.

Inflation vs. “Low-Risk” Investments

In today’s yield environment, it is a challenge for an investor who is looking for safe investments that can keep up with rising costs over time. In the investment world, we often refer to U.S. Government bonds and savings accounts as “low risk” investments. While no investment is completely void of risk, we often refer to short-term Treasury Bills when talking about low-risk options for U.S. investors. These Treasury Bills are often owned in money market accounts because of their lower volatility. The challenge is that yields on these safe investments have declined in recent years, and are now so low that they lack the ability to keep up with rising costs over time.

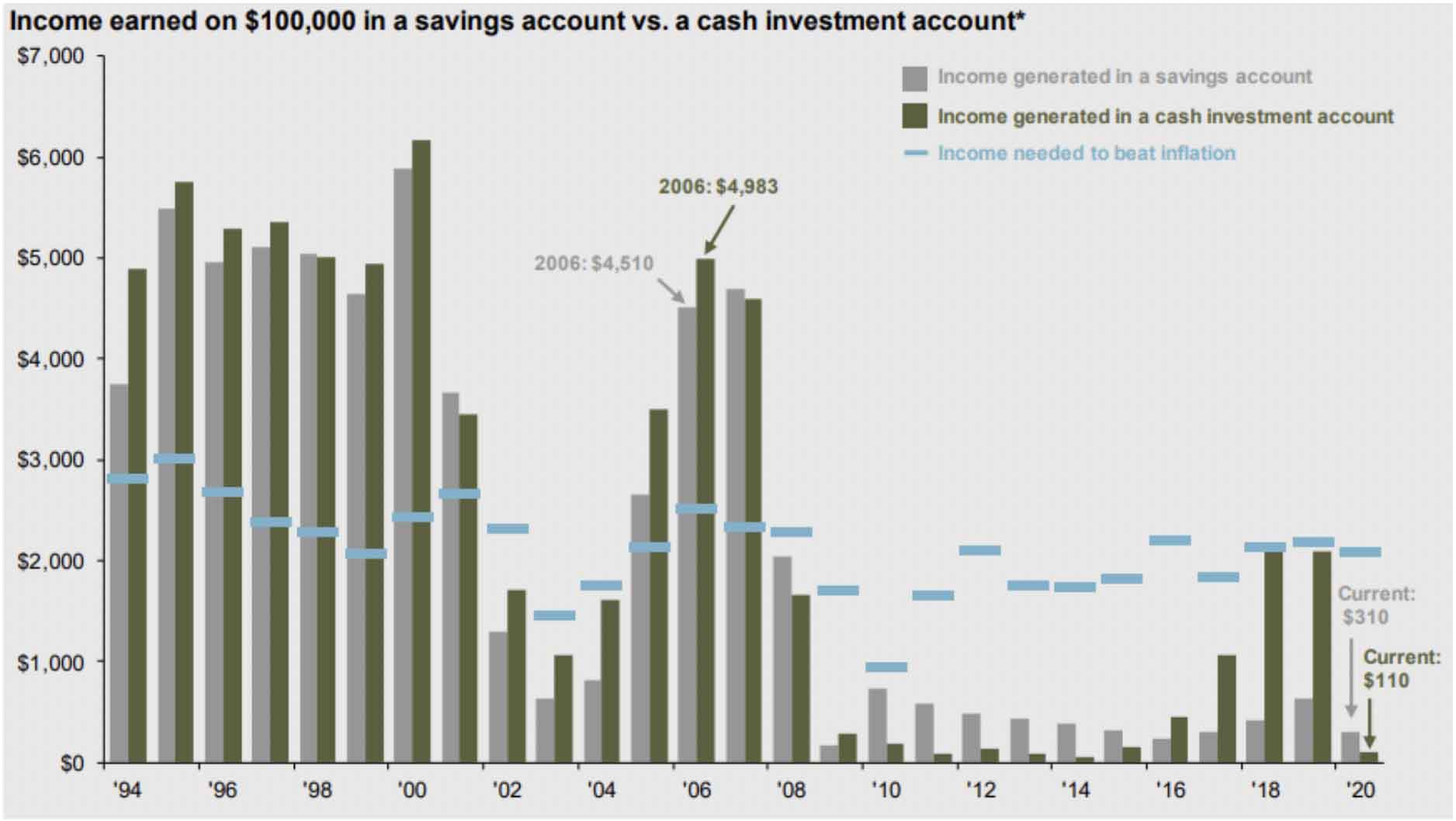

Source: J.P. Morgan Asset Management

The chart above shows the interest my grandmother would have earned in the early 1990s, had she invested in a savings account. This amount, while lower than long-term stock or bond returns, was able to surpass the rate of inflation shown by the blue lines. However, when looking at the past 10 years, interest rates have been so low on savings accounts that my grandmother’s real rate of return (interest rate minus inflation) would actually have been negative.

Keep Up With Rising Costs

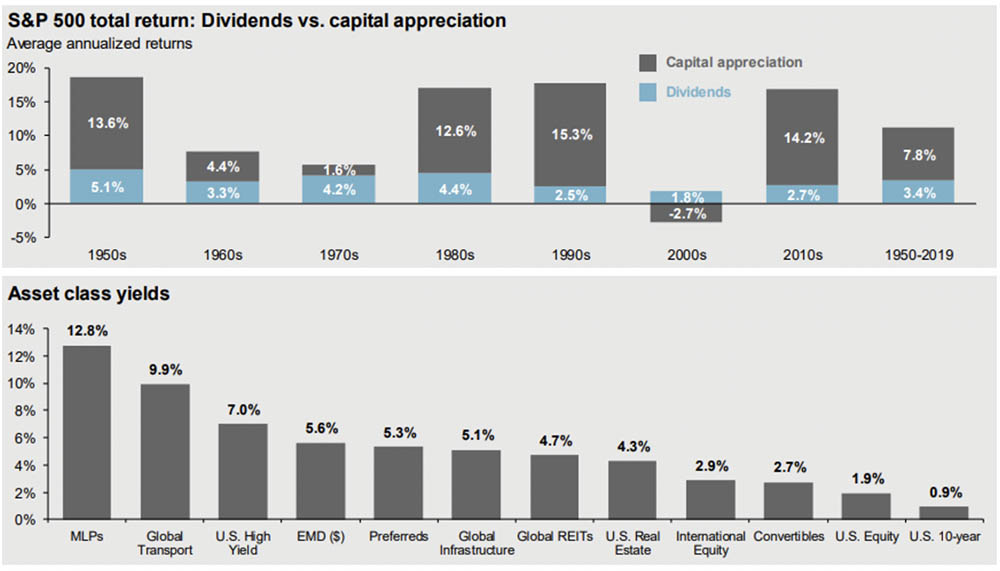

While real yields on savings accounts and short-term government bonds are currently negative, there are options for investors that are looking to generate a yield on investments that are not designated for short-term needs. The next chart shows the dividend yield of common stocks over the last 70 years.

Source: J.P. Morgan Asset Management

The bottom chart lists the yields on a variety of other investment options. Some of those asset class yields are high, because of the volatile nature of the industry. The current yield on stocks is near 2% on U.S companies and 3% on international.

Stocks also have the added benefit of capital appreciation (the rise in their market price) over time. In fact, Between 1950-2019, stocks averaged a total return of over 11% a year — and two-thirds of that growth was from price appreciation.

Investing in equities is not without risk (please refer to the stock market volatility in March and April of this year), but over longer term time periods, investing in stocks can help investors stay ahead of inflation.

Grandma Betty’s strategy of investing in bonds and savings accounts allowed her to sleep at night and stay ahead of inflation during the 1980s and 1990s. Low interest rates of today, however, have caused many investors to look outside traditional income-producing investments to generate a rate of return in-line with longer-term goals. If your income has not kept pace with your expenses, please do not hesitate to reach out to your advisor to make sure your investments are aligned with your goals.