In Volatile Times: Stay Focused On What You Can Control

April 28, 2025

By Dustin Saia

By Dustin Saia

Securities AnalystSo far in 2025, financial markets are highly sensitive to the next headline or breaking news piece related to trade, tariffs, and geopolitics. With this level of volatility, it is easy to be consumed by such headlines and concerned with what may come next. For long-term investors, one strong defense against volatility is staying diversified for the long haul. Another strategy to combat volatility, and remedy any headline fatigue we face, is to focus on things within our control as investors and ignore those that are not.

What Can I Control?

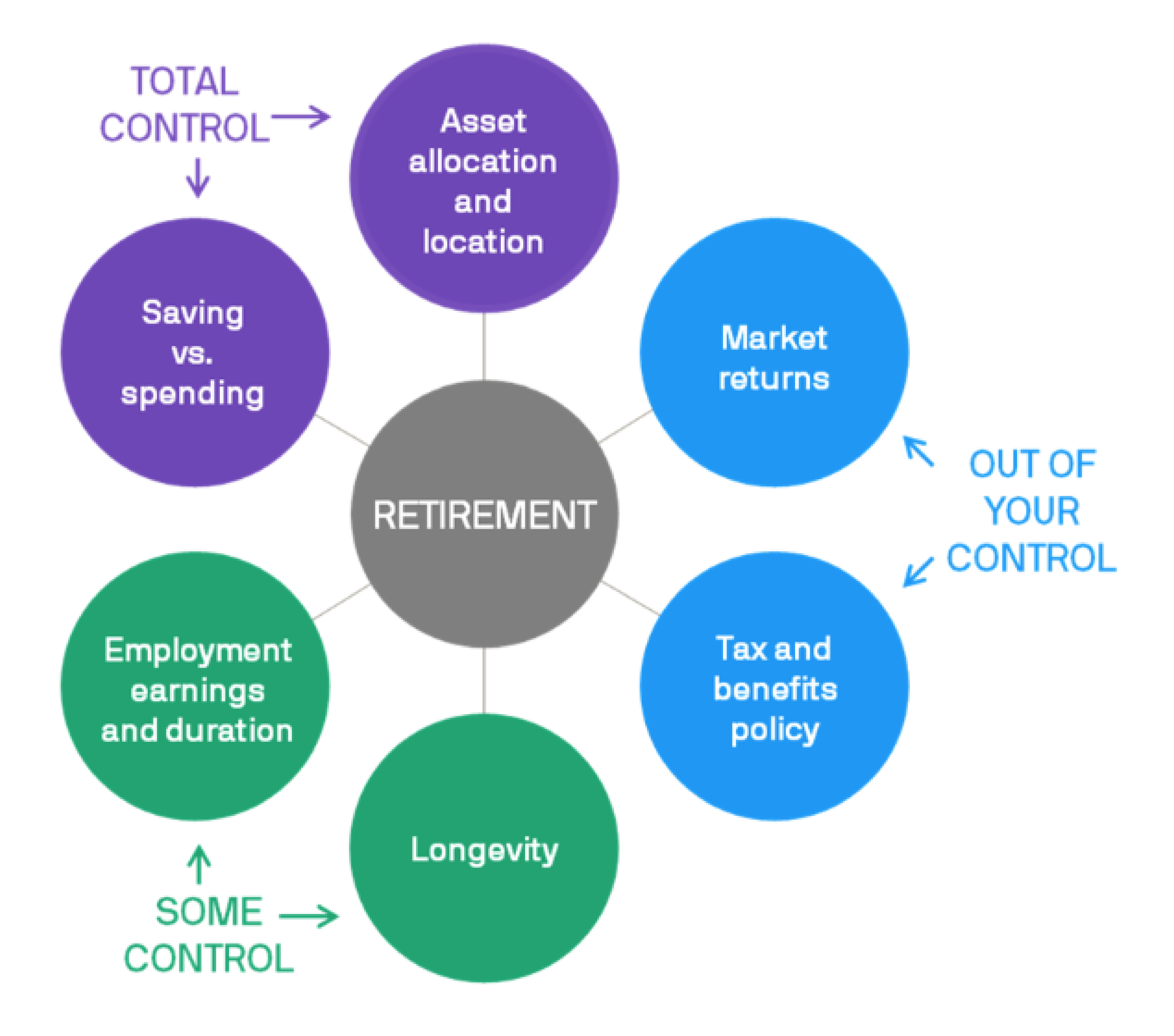

When thinking about investing, it is always best to start with a plan. Establishing a financial plan can assist in laying out your financial goals and identify factors that will influence whether that plan succeeds. The chart below lists six factors that are considered major drivers for successfully reaching an investment goal. In this case, saving enough for retirement is used as the main investment goal, but any goal can use this framework.

Source: JP Morgan

While each factor influences an investment plan, not all factors can be directly controlled by an investor. Generally, investors do not influence the direction of policies on issues like trade or on the overall returns from the market. Therefore, these uncontrollable factors should be incorporated into an investment plan but should not receive most of our attention. Some factors are partially within the control of an investor, such as longevity or employment earnings. While investors can take actions to improve their odds of success in these areas, there is no guarantee of future results. Finally, there are a few factors that are completely within the control of an investor including saving versus spending, asset location, and asset allocation.

Achieving Your Goals

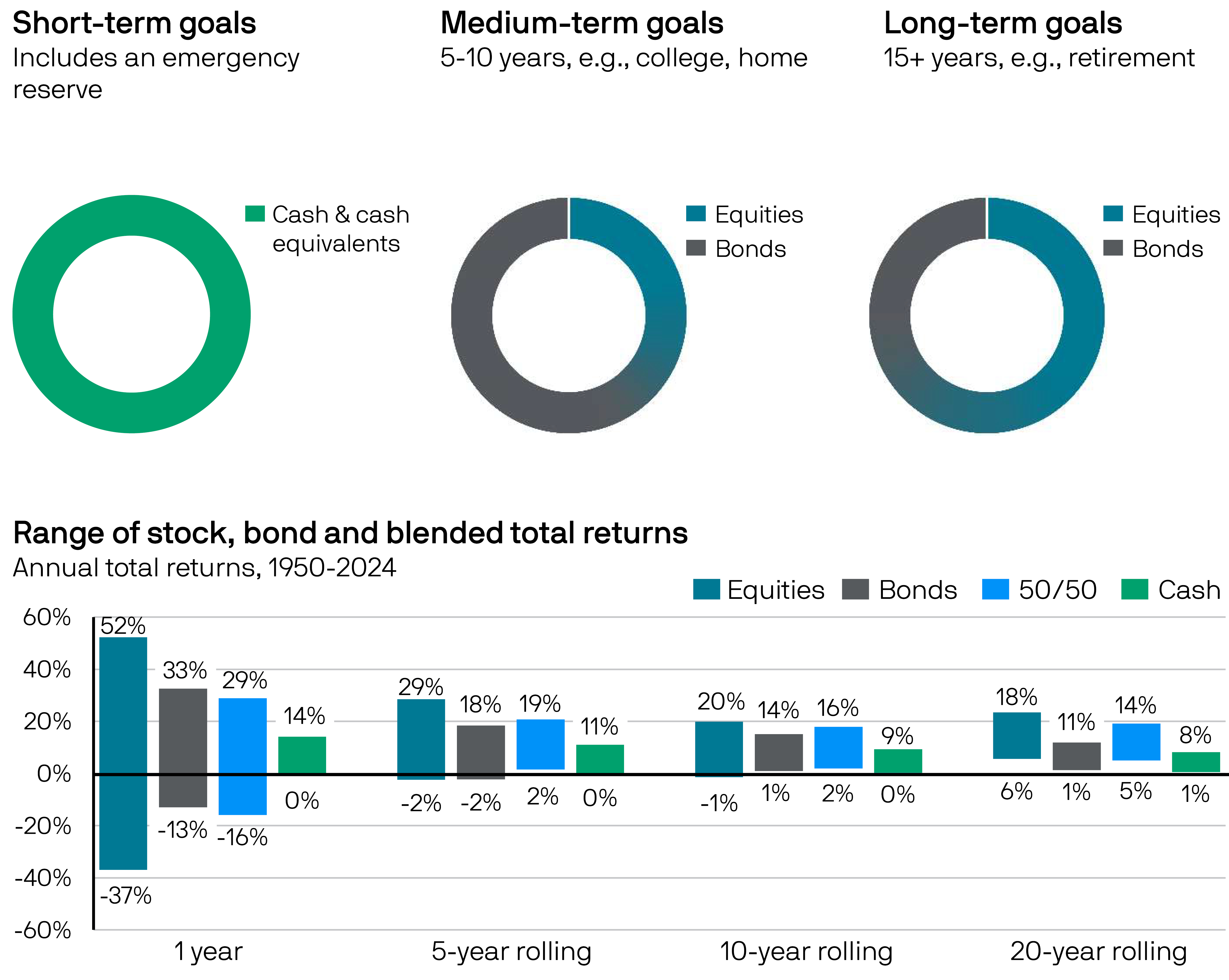

The best way to achieve your investment goal is to focus on the factors that you have total control over. First, ensure savings are being maximized and manage spending efficiently to support this process. Next, confirm investment assets are in the correct location for their intended goal and are utilizing tax-advantaged accounts. For example, if the investment goal is to save for a child’s future education expenses, investments could be located within a 529 plan for tax-deferred earnings and tax-free withdrawals for qualified educational expenses. Many investment accounts exist to serve the purpose of providing tax breaks for investment goals such as retirement, education, and healthcare. An effective investment plan will ensure you are utilizing the proper accounts for your goals. Lastly, align asset allocation with the investment goal’s time horizon. The chart below illustrates this point by providing an outline of an appropriate asset allocation for short-term, medium-term, and long-term goals. Given the range of total returns for equities, bonds, a 50% blended portfolio of the two, and cash, shorter-term goals will be funded through cash investments to protect against short-term market volatility. For long-term goals, more assets should be invested in equities as they provide the highest upside over a 20-year rolling period.

Source: JP Morgan Data as of 4/28/2025

Each investment plan is unique and should be catered to your goals and priorities as an investor. In times of volatility, it can be reassuring to know there is a plan in place and to focus on factors within our control. Please reach out to your Wealth Management Advisor today to update your financial plan and ensure we are on track to meet your goals. Your success matters to us.