Painting the Bigger Picture

November 21, 2025

By Michael Moreland

By Michael Moreland

Retired Vice President - InvestmentsOne of the enduring habits of many investors is to look at recent market activity and extend a straight line to predict the future. That’s certainly happening now. Cracks are appearing in the formerly invincible ramparts of the AI market surge (despite Nvidia’s strong earnings report), and murmurs of a new bear market are growing louder. While there are many causes for concern (monetary policy, debt accumulation, an increasingly unstable job market, and housing affordability to name a few), there are few times in history where the investing seas were calm. One of the oldest – and truest – axioms of investing is that markets ‘climb a wall of worry’. We believe that remains true today.

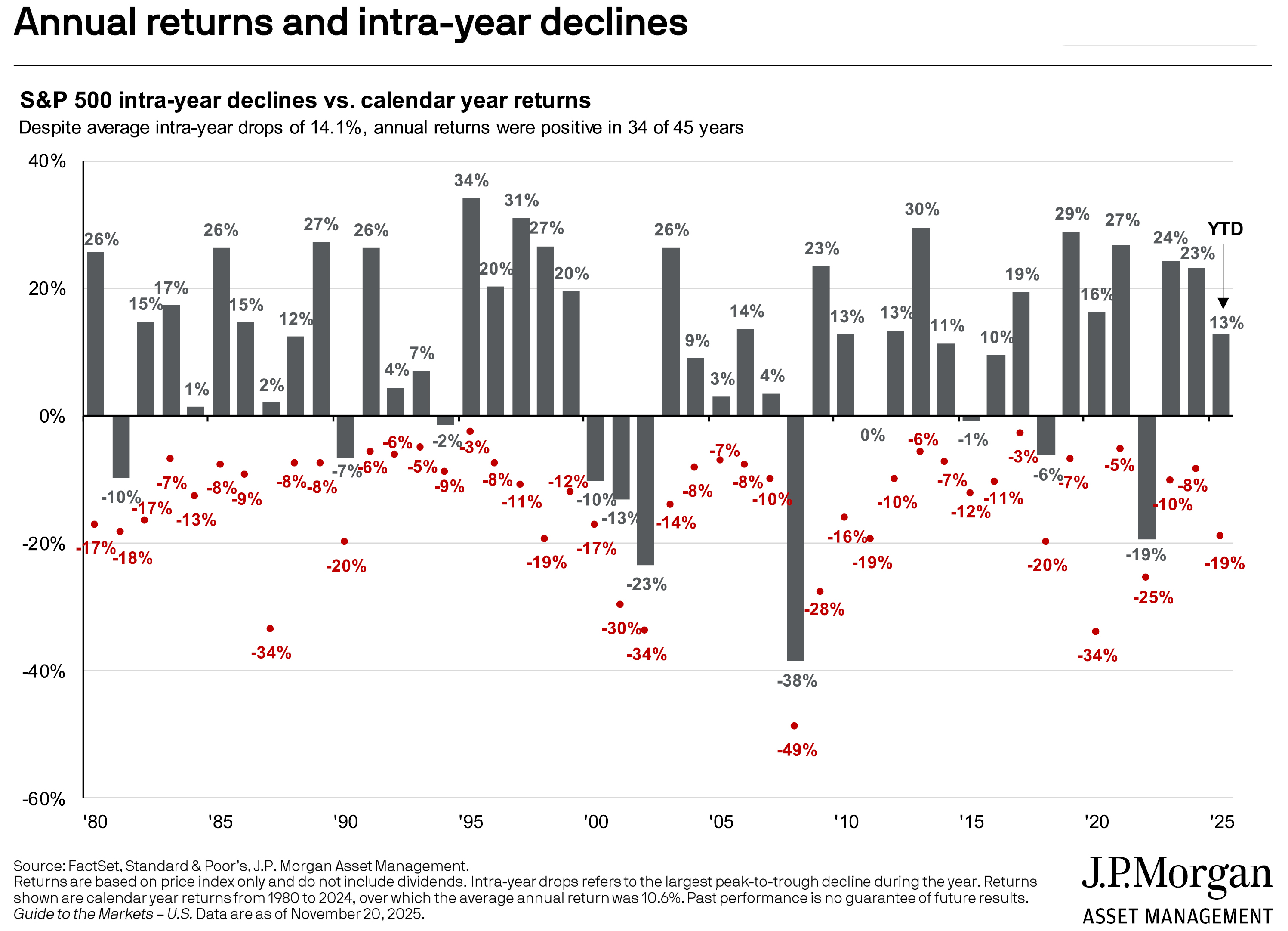

While recent trading sessions have been disturbingly sharp, they are not unprecedented. The chart above looks back nearly a half-century. Intra-year declines averaged in the mid-teens over this period, with drawdowns triggered by a wide variety of events – some more severe and long-lasting than others. At the end of the day, however, the S&P 500 ended in positive territory in 34 of the 45 years.

Focus on Valuation

Will that positive history repeat in 2025 – and 2026? We believe so. The caveat is that in the near term anything can happen – and usually does. Short term forecasts, usually provided with great authority, should be taken with several grains of salt, if at all. Conscientious investors focus on a longer term goal and behave accordingly, with an emphasis on consistent application of proven disciplines.

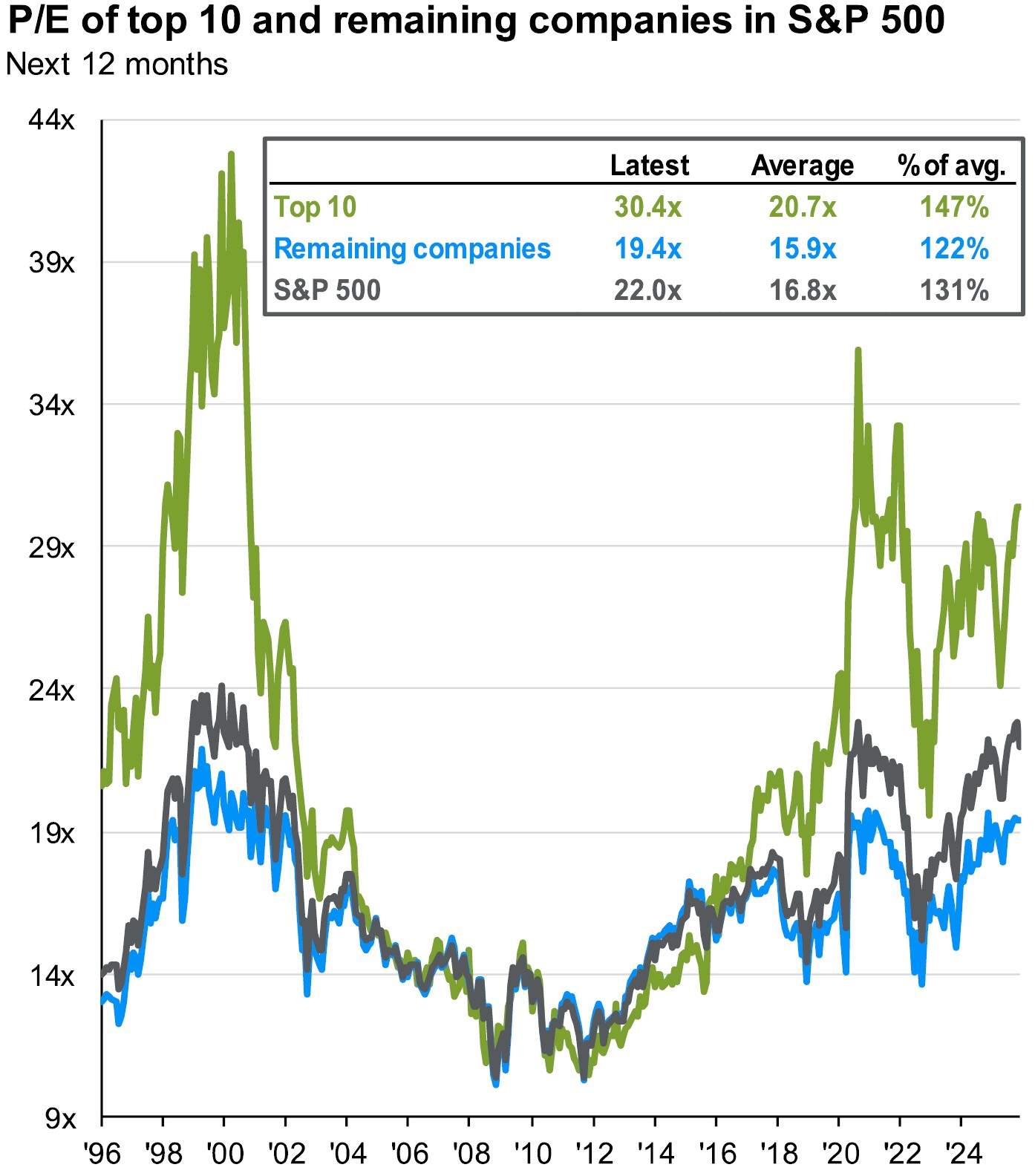

Our core discipline is attention to valuation. While we are broadly diversified among sector, style, and geographic exposures, a common thread is our effort to identify and hold those issues with the most reasonable valuations compared to their growth potential. While valuation can be measured by many metrics, our emphasis is on the price-to-earnings (P/E) ratio. In essence, this tells you how much you are paying for your proportionate share of a company’s expected profits. The lower the ratio, the better.

And, history shows that periods of low starting valuations are generally associated with higher five-year prospective returns than those that begin from higher levels. This makes clear intuitive sense – we’ve all heard the adage ‘buy low and sell high’. The chart below clearly shows this pattern.

The concerning aspect of this array is that, based on current valuation of the S&P 500, we are possibly in line for a several-year period of essentially no net market progress. While this is not cast in stone, keep in mind Mark Twain’s quip – ‘history doesn’t repeat itself, but it does rhyme’.

Finding Where Opportunity Lies

A closer look at the data provides a better picture for conservative investors. We have written often of the growing concentration of the S&P index in a handful of technology and AI-related firms. As of October 31, the ten largest companies in the index comprised 41% of its total value. And, their P/E ratios averaged over 30X earnings. In contrast, the remaining 490+ companies sold at less than 20X their expected earnings.

These companies – and others across the globe – are strong areas of relative opportunity. While high-value technology and AI sectors will still drive the major indices, investors who focus on building diversified portfolios with a strong valuation discipline should do well.

In sum, the equity environment is more than a handful of mega-capitalization companies. While these will dominate the headlines and index behavior, remember another old adage – it’s a market of stocks, not a stock market.

Let us know how our philosophies work to both protect and build the wealth you entrust to us.

Talk to your Investment Manager and Advisor for an in-depth review of your portfolio. Your success matters to us.