Positive Third Quarter GDP: Trick or Treat?

October 31, 2022

By Samuel Richter

By Samuel Richter

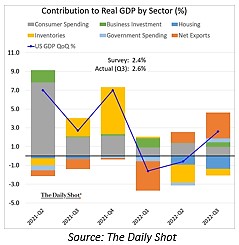

Securities AnalystUnited States Gross Domestic Product (GDP) rose 2.6% in the third quarter. While positive GDP is a treat, there may be a hidden trick. We are not out of the woods yet when it comes to recession fears.

Positive third quarter economic growth follows two consecutive quarters of negative GDP, which met the textbook definition of a recession. As my colleague discussed in Are We in a Recession or Not?, a strong labor market complicates that answer.

The trick that still haunts The Fed: Bringing down inflation

The yield curve remains inverted, historically a predictor of a future recession. Companies are concerned with slowing demand, as consumer spending slowed in the third quarter. As a reminder, the Federal Reserve is attempting to weaken demand by aggressively raising interest rates. This is its goal for slowing inflation.

The Fed meets again this week. A 0.75% (75 basis point) rate hike is expected. Fed Chairman Jerome Powell will speak on Wednesday following the meeting. The markets will key in on what Chairman Powell says about expectations for rate increases moving forward. In previous meetings, the Fed has reiterated that it is determined to do whatever necessary to bring down inflation.

It is important to remain focused on the long term during uncertain times. The markets are forward looking, meaning they already priced in some of the recession fears. It also means that if you think you can get out of the markets until things turn around, you likely will be too late. History has shown trying to time the markets has caused the average investor to miss out on returns in the long run. Contact us today to see how your portfolio is built for long-term success.