Savers Enjoy Short and Long-Term Rewards, But Borrowers Beware

August 21, 2023

By Ted Hanson

By Ted Hanson

Portfolio ManagerOver the past year we’ve often talked about inflation, the Federal Reserve, and short term interest rates. Through all of that we’ve experienced a noticeable slowdown in inflation, one of the most extreme fiscal policies in the Fed’s history, and a significant rise in short term rates. However, because of the shape of the yield curve, long term rates became an afterthought. Is it time to reconsider?

Yield Curve, Explained:

In the past we wrote about an inverted yield curve and what that means for future expectations. To refresh, an inverted yield curve is when short-term interest rates are higher than those on longer maturities. This is an environment we are in today, because of the drastic rise in the Federal Reserve’s Fed Funds rate (boosting short-term rates), in combination with market expectations of slower economic growth in the future (placing downward pressure on long-term rates). However, there has been a significant rise in long-term rates over the past couple weeks, helping close that difference.

Expectations Higher Amid Economic Resiliency

Market participants have taken notice of the economy’s resiliency. While progress has been made on the inflation front, the labor market remains historically tight. In addition, retail sales in July blew past expectations. The 0.7% increase in July was almost double expectations and the largest monthly gain since January, signaling consumer demand remains strong. Combined with other positive economic surprises, economists have begun to revise gross domestic product (GDP) expectations higher. These pushed back recession outlooks and created some optimism, as shown in long term yields.

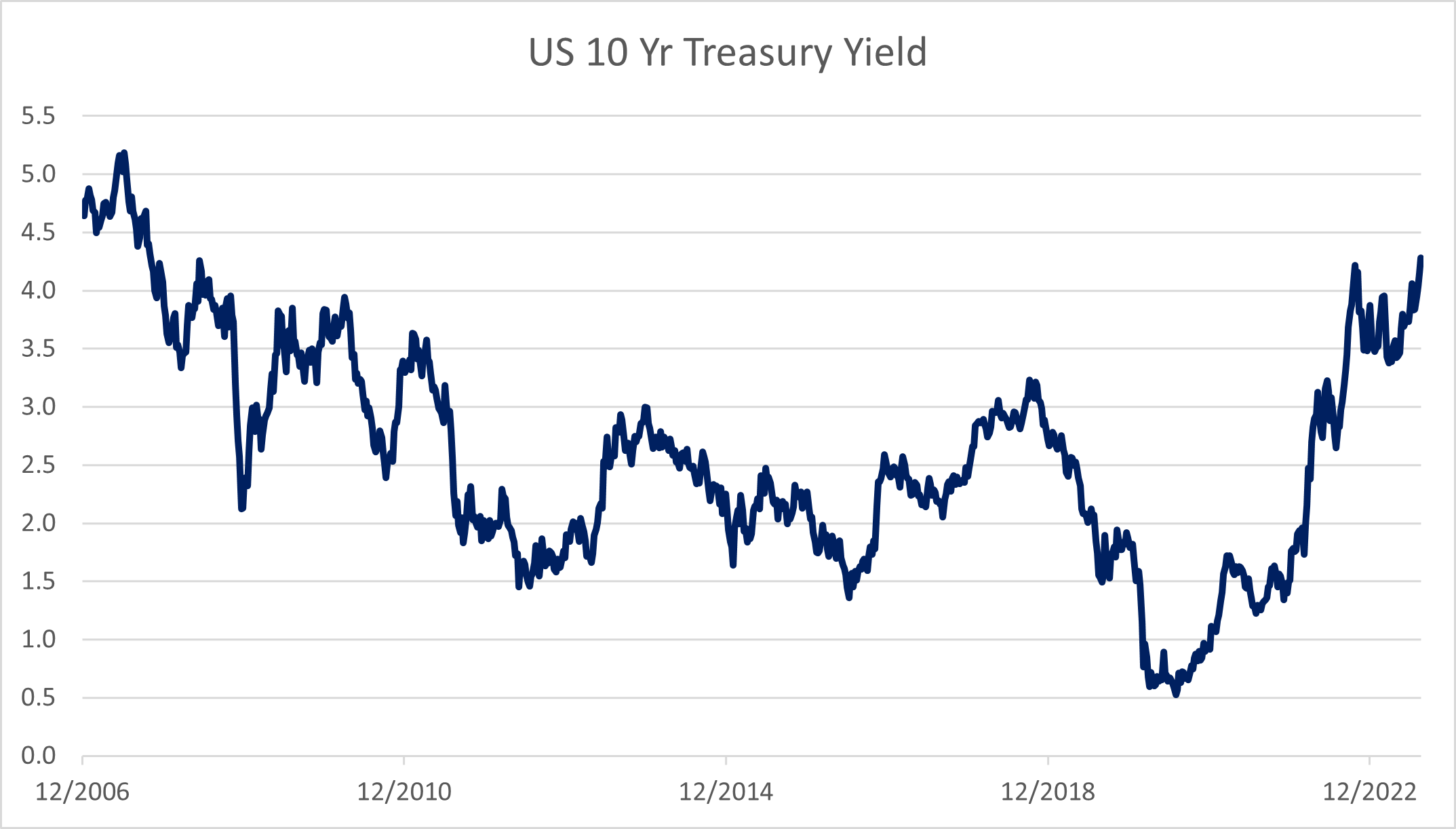

Source: Bloomberg

Borrowers Face Challenges Not Seen In 20 Years

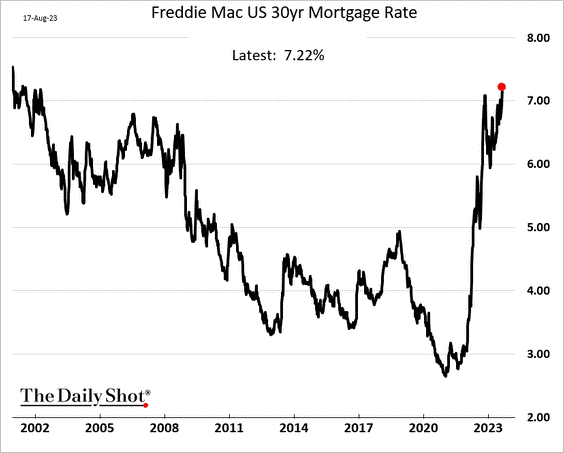

As you can see in the chart above, the 10 year Treasury is trading at yields not experienced in 15 years. This will likely attract investors looking to lock in elevated rates for longer. While higher rates are enjoyed by investors, they do not feel the same welcome from borrowers. Average mortgage rates (which have a correlation to the 10 year Treasury) have risen to over 7%, their highest level in more than 20 years. In combination with increased balances of auto loans, credit card debt, and the restart of government student loan payments, many households are experiencing the pressures of rising interest rates.

While the economic outlook and investment opportunities have increased, risks remain to the downside. The recent strength of the consumer may lead to additional economic growth, risking upward pressure on inflation. With inflation already still above the Fed’s target, short term interest rates are expected to be higher for longer. Under this scenario, households looking to save will continue to be rewarded, while those looking for credit will be challenged.

What This Means For You:

Accounts under our charge will remain fully invested throughout an economic cycle. The rise in long term interest rates will continue to provide opportunities to boost income streams. If you’d like to review how the rise in yields play a role in your portfolio, reach out today! Your success – and safety – matter to us.