The K-Shaped Economy

November 10, 2025

By Krista Biernbaum, CFP®, CIMA®

By Krista Biernbaum, CFP®, CIMA®

Investment Management OfficerRemember the alphabet soup from 2020? Let me refresh your memory. Coming out of the Covid-induced recession, there were discussions on how the economic recovery would play out. A variety of letters were used in predicting the shape of it, such as a U, V, K, W, or L-shaped recovery to name a few. This year, one of those letters is resurfacing to describe the direction of the U.S. economy in 2025: K-shaped. Let’s discuss.

Back in April around Liberation Day, there were fears among investors and economists around tariffs triggering a U.S. recession. As time went on, those fears lessened, and the U.S. economy proved resilient yet again. Gross domestic product (GDP) showed the U.S. economy growing 3.8% in the second quarter on an annualized basis. Projections for third quarter growth are around 3%. All seems well on the surface. However, if we dive deeper, we are seeing a bifurcation among U.S. consumers.

Is the Economy Strong for All?

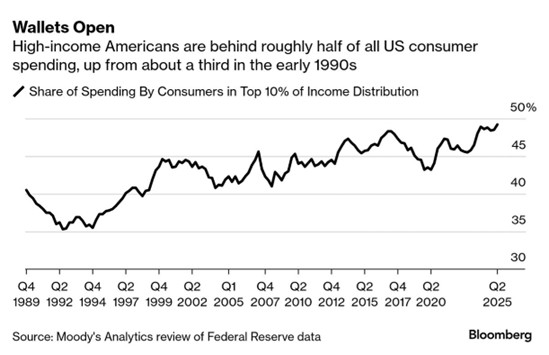

Below is a chart from Bloomberg showing the share of consumer spending contributed by the top 10% income earners. Over the past thirty-five years, these individuals have gradually increased their share of overall spending for the U.S. economy. We witnessed a reversal of this trend in the years leading up to the pandemic, as more individuals participated in the economic expansion. Since Covid, that trend reversed. In fact, in the second quarter of 2025 the top 10% income earners accounted for almost half of all the consumer spending in the economy! Also, it is at the highest level in thirty-five years!

Source: Bloomberg

The Divergent Paths for Lower and Higher Income Consumers

These top earners are still showing signs of spending. The lower income households face a more challenging environment. Delinquencies on auto loans and credit cards are increasing, higher costs from tariffs are weighing on those living paycheck to paycheck, Covid savings are depleted, and we are seeing companies lay off both low and middle-income individuals. This is where the K-shaped economy comes in. The higher income category is still in a good place, are able to participate in the stock market recovery, and as a result are seeing their wealth increase. In contrast, lower income individuals are feeling the pain and are decreasing spending as a result (the negative sloping line of the letter). This divergence means each consumer differs in the picture they paint of the current state of the U.S. economy.

Why does this matter? Consumer spending comprises over two-thirds of U.S. economic growth. As long as the top income individuals continue to spend, given their disproportionate representation, the U.S. economy will move forward from here. With that being said, we are keeping an eye on the health of all consumers and implications for growth going forward. Clearly, a rising tide is not lifting all boats…

The tax law changes passed this summer are expected to be a temporary boost to all consumers when taxes are filed in the first part of 2026. This is why most economists forecast U.S. growth to pick up in the first half of next year before slowing down again. Obviously, the current government shutdown and length of it will negatively impact growth and the broader consumer spending over the near term. This is a situation we are watching closely as it evolves. In the meantime, if you would like to talk about the current state of the economy or the consumer,

please reach out to your advisor today.