The Hidden Risk in Your Mailbox: What You Need to Know About "Check Washing"

December 19, 2025

By Jennifer Pennings

Assistant Vice President, Retail

Have you ever mailed a check to pay a utility bill or a credit card, only to find out weeks later that the payment was never received—but the money is missing from your account?

You may have been a victim of check washing, a "low-tech" scam that is making a massive comeback according to the US Postal Inspection Service. In 2025, criminals are increasingly targeting the very thing we thought was convenient: pre-printed return envelopes.

What is Check Washing?

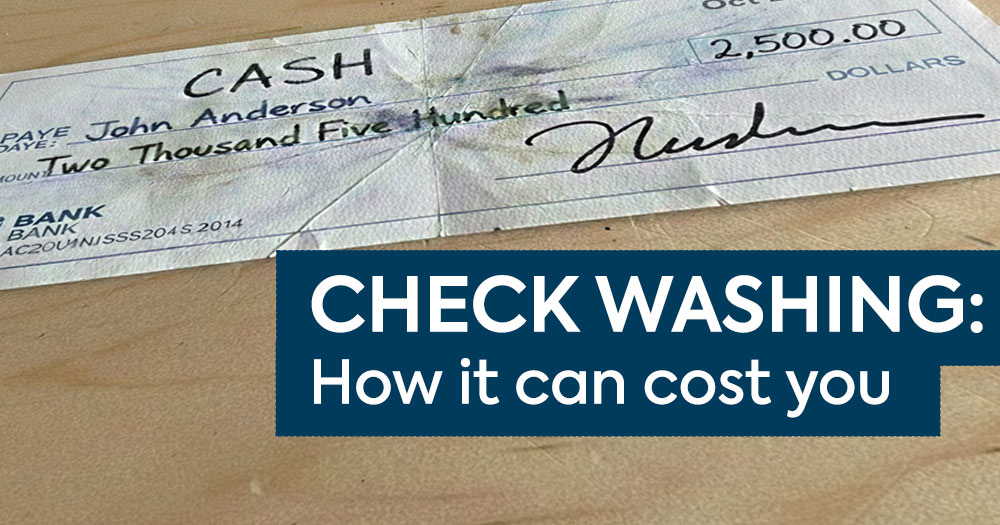

Check washing is a form of fraud where criminals steal mail to find envelopes containing checks. Once they have a check, they use common household chemicals (like acetone or bleach) to "wash" off the ink in the "Payee" and "Amount" fields.

Because they leave your signature intact, they can rewrite the check to themselves—or to an accomplice—for thousands of dollars more than the original amount.

What is Digital Check Washing?

As scammers get more sophisticated, many no longer bother with the messy chemical process of physical check washing; instead they simply take a high-resolution photo of the stolen check and use digital editing software to change the recipient or amount before cashing it.

That's why it's important to stop a fraudster from intercepting your check in the first place.

The "Return Envelope" Trap

Many of us use the pre-printed return envelopes provided by utilities, doctor’s offices and other bill providers. While convenient, these envelopes are high-priority targets for "mail fishers."

- Easy Identification: Criminals look for the distinct size and weight of these envelopes in residential mailboxes or blue USPS collection boxes.

- The Interception: Thieves often "fish" mail out of boxes using string and sticky tape or target unsecured home mailboxes where the red flag is raised.

- The Result: Your check is intercepted, washed, and cashed before the company even knows your payment is late.

How to Protect Yourself

You don’t want to stop paying your bills, but you should change how you pay them. Here are the most effective ways to stay safe:

-

Go Digital (The #1 Defense): The safest way to avoid check washing is to stop sending paper checks altogether. Use your bank’s online bill pay or a provider’s secure website to pay your bills. Electronic payments don't have ink that can be washed and don't sit in a physical mailbox.

- Monitor Your Accounts: Don't wait for your monthly statement. Check your bank's mobile app every few days to ensure that the checks you wrote were cashed for the correct amount and by the right person. For example, inside the SNB Mobile App, you have the option to view a thumbnail image of every cashed check you've written -- and we recommend checking every single one to make sure nothing is altered. If something is off, contact your bank immediately.

- Secure Your Outgoing Mail: Never leave a check in an unlocked mailbox overnight. If you need to mail a physical check, take it directly to the inside of the nearest Post Office.

- Use a Safe, Permanent Pen: This is a simple, first line of defense against fraud. The American Bankers Association (ABA) recommends using permanent gel ink to prevent basic alterations, because it bonds better to the paper fibers and is less prone to "check washing" than standard ballpoint ink. However, it is crucial to remain vigilant: while the right ink could deter physical check washing, it will not stop a sophisticated scammer who uses digital editing software.

What to do if you're a victim of check washing:

If you notice a suspicious check transaction, act immediately:

- Notify your bank to stop payments and secure your account.

- File a report with the U.S. Postal Inspection Service.

- Contact local police to create a paper trail of the fraud.