How To Spot and Avoid a Credit Card Skimmer at the Gas Pump

February 16, 2023

By Chris Jackson

By Chris Jackson

V.P. of Retail BankingThe use of gas pump card skimmers has become prevalent all over the country — even in Siouxland.

However, you can minimize your risk of being a target if you're watchful for common signs that a fuel pump has been compromised. In this article, we'll show you the best ways to avoid having your card skimmed at the gas pump.

What are credit card skimmers?

Credit card skimmers are devices that criminals attach to ATMs, gas pumps, and any other payment terminals to steal your card's information. Skimmers come in all shapes, sizes and varying degrees of complexity.

What does a credit card skimmer look like?

- Some skimmers are physically attached to the machine, extending the card slot so that it captures your information as you slide your card.

- Other criminals install hidden cameras to capture your PIN or zip code, and then slip away with your money without even needing your wallet.

- Some thieves install fake keypads, replacing the need for cameras.

- Sometimes, Bluetooth and cell phone technology can be used to retrieve information from skimming devices — meaning criminals don't even need to be at the scene of the crime when it happens.

- Finally, criminals are now using "card shimming" devices, paper thin strips hidden inside the card slot that can be used to clone the magnetic stripe on your card.

How to detect gas pump skimmers

Most of us are in a hurry when we fill our gas tanks. But if you remain vigilant and take some standard precautions, you'll be able to detect gas pump skimmers of all types, and stay safe at the pump.

1. Check the pump panel for tampering.

This lockable door on the gas pump or ATM should be closed and securely fastened; many gas stations take the additional step of placing a tamper-resistant seal over the door. If the tamper-resistant seal is broken, do not use the gas pump, and tell an employee that the pump may not be safe to use.

Source: Ocala (Fla.) Post Website

2. Inspect the card slot and the PIN pad (compare with other pumps).

Try to wiggle the card slot. If it seems loose, or strangely bulkier than the other pumps at the same station, you may want to move along to another terminal. Likewise, if the PIN pad seems obtrusively thick, or if it does not match the pads on other pumps, this is a clear sign that something is amiss.

The skimmer on the left is loose if you wiggle it. The picture on the right is how the pump should look. Source: Kamloops RCMP

Pictured above is an example of a well disguised skimming device. Note how bulky it is. Source: CBS Channel 4, Miami

3. Be on the lookout for hidden cameras.

High-tech data thieves sometimes use tiny cameras to obtain card information as you type it into the PIN pad. Be on the lookout for tiny pinhole cameras, or phony screen shades attached above the screen display that may conceal a hidden camera. Most importantly, if using the PIN pad, always shield your PIN with your hand.

A scammer's camera is cleverly hidden in the gray casing. Always cover your hand when you enter your PIN. Source: WTAQ (Wis.) Radio

4. Avoid the PIN pad entirely.

Even if you are paying for your gas with a debit card, if possible, run the card as a “credit card” instead. Most financial institutions, including Security National Bank, allow you to do this. Not only does this afford you additional protection because the funds aren't immediately drawn out of your account, it also allows you to avoid entering your PIN entirely. Another way to avoid the PIN pad, if you're still wary of a pump's payment system, is to simply pay for your gas inside.

5. Choose the pump closest to the gas station.

Thieves often install their skimming devices on the least attended pumps at a gas station, so if possible, choose a pump close to the physical building or the cashier's line of sight. Also, try to fuel up at trusted stations that have cameras installed as an extra security measure.

What's next? Watch out for card “shimming”

With the advent of chip-enabled debit cards, card users have a great way to protect themselves from skimmers. These chip-based cards are by far the safest form of card to use at a payment terminal, but there is still a risk to using one.

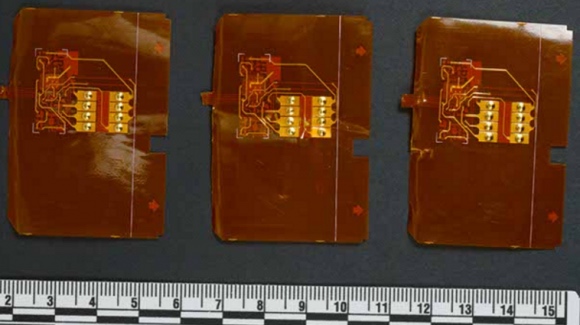

Card “shimming” is a new technique scammers use to target chip-based credit and debit cards. A “shimmer” is named as such, because it acts like a shim, sitting between the reading device and the chip on the card you insert. Shimmers are much harder to detect than skimmers because they are paper-thin devices that actually sit inside the reader, hidden from plain sight (see below photo). No matter how much you’ve learned about how to spot skimmers at gas pumps, you’d have a hard time spotting a device completely hidden from view.

Although thieves cannot use the stolen chip information to fabricate a new chip card (the technology is too sophisticated), in some instances they could use the chip data to create a “clone” magnetic strip card to use — but only if the bank issuing the chip card hasn’t followed the right procedures. As long as your bank has taken proper precautions and implemented the chip card standard known as EMV (short for Europay, MasterCard and Visa), your chip card will still be safe. This is because the EMV standard adds an additional layer of security that protects against the copying of magnetic stripe data — even from “shimmers.”

At Security National Bank, we follow all procedures to ensure our chip debit cards are equipped with the necessary EMV protection mechanisms to keep your information secure.

The first line of defense is you

As always, monitor your bank accounts closely for any suspicious activity. If you find anything, report it to your financial institution and law enforcement right away. Luckily, with tools like mobile banking, monitoring your account activity is now easier and more convenient than ever!

Want to get great financial security tips every month? Sign up for SNB's monthly newsletter, and get great content handcrafted and delivered to your inbox.