'Tis the Season for Holiday Scams. Here's How to Spot Them and Avoid Them

November 20, 2020

By Chris Jackson

By Chris Jackson

Assistant V.P. of Retail ServicesRetailers and shoppers aren’t the only ones gearing up for the holidays. Scammers are too. In fact, the threat of fraud and identity theft typically increases during the holiday season This time of year, it’s important to watch out for secret shopper scams, Christmas phishing scams and other common holiday scams:

1. Relative Impostor Scam

Also known as a "grandparent scam," this crime involves an impostor contacting a senior citizen, posing as a grandchild or other family member, and fabricating a family emergency that requires immediate financial assistance. They may impersonate your loved one convincingly, play on your emotions and insist that you send money right away. They will also demand that you don’t tell anyone. Grandparent scams are some of the most sinister holiday scams because they are so personal and manipulative.

Here's an example of a relative impostor or grandparent scam:

Source: Federal Trade Commission Consumer Information

What to do if you encounter an impostor scam:

- Do not react immediately, no matter how urgent the caller says the emergency is.

- Verify that the caller is really who they say they are by asking personal questions that a stranger couldn’t possibly answer.

- Contact the person who is supposedly in trouble, or try to get ahold of someone else in your family or circle of friends. Chances are, someone can quickly verify whether the person supposedly contacting you really needs help or if it’s a scam.

- Do not send money via wire transfer, gift card codes or any other transfer method.

- Report the fraud at ftc.gov/complaint or by calling 1-800-FTC-HELP.

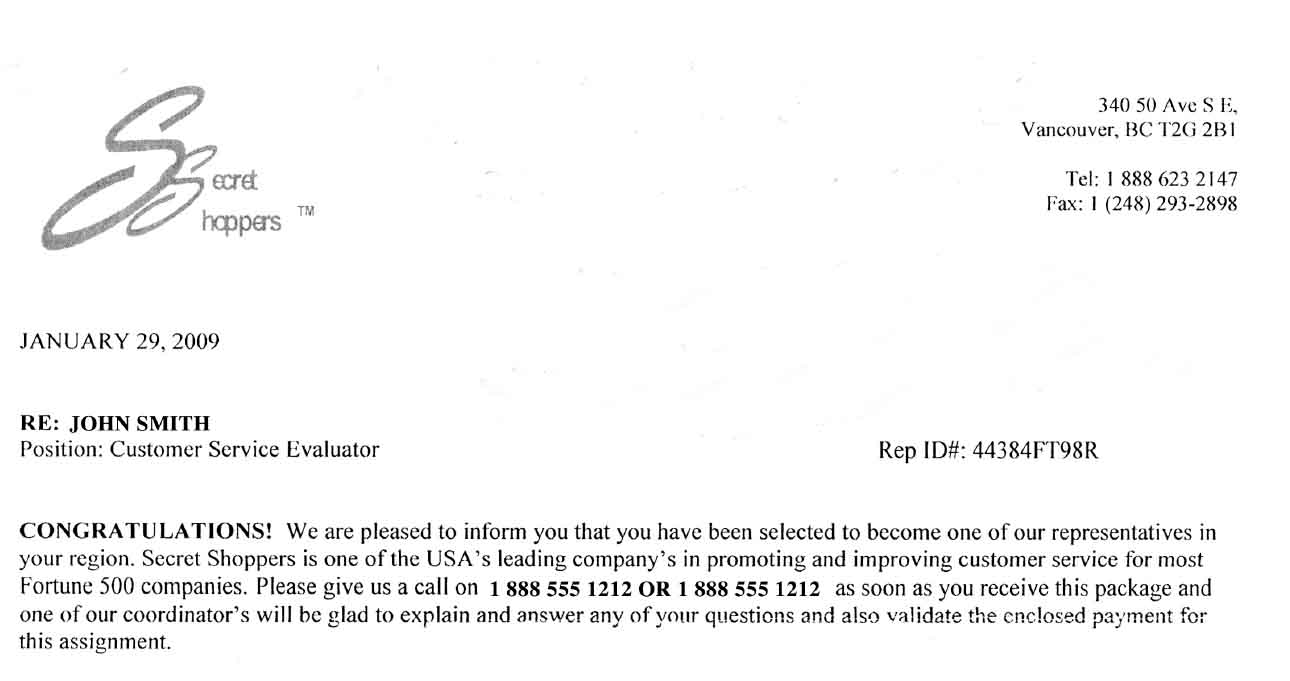

2. Secret Holiday Shoppers and Secret Shopper Scams

There is such a thing as legitimate mystery shopping. And over the holiday season, legitimate companies may hire secret holiday shoppers to evaluate a retailer based on certain customer service and shopping experience metrics. Usually, these companies invite strangers to make certain purchases and report on their experience. In these cases, the shopper is reimbursed and usually gets to keep the product they buy.

But even though there are legitimate secret shopping opportunities, scammers often take advantage by posing as bogus secret shopper companies and luring people into secret shopper scams. Scammers typically try to recruit participants online, by phone, or through the physical mail. Most secret shopper scams end up conning victims into paying some sort of application fee when they sign up. If you fall for a secret shopper scam, not only will you lose money, but you may also put your online safety at risk.

Here’s an example of Secret Shopper Scam:

Download Example (PDF)

Source: United States Postal Service

What to do if you witness a Secret Shopper Scam:

- Never trust a secret shopper offer that you didn’t initiate or apply for. This means never giving out personal information over the phone unless you are the one who initiated the call.

- If you’d like to be a secret holiday shopper, look for legitimate opportunities. If you want to avoid secret shopper scams, research any mystery shopping job you find and check to see if the company is a member of MSPA - Mystery Shopping Professionals Association. This is an official, global association for mystery shopping companies.

- Never pay any sort of fee to be a mystery shopper. Legitimate companies don’t charge people, they pay people to work for them.

- If you run into any secret shopper scams, report them to the FTC or your state’s attorney general.

3. Charity Fraud

In this scam, a criminal approaches a victim and pretends to represent a charity - either online, by phone or sometimes even in person on the street. Many times, the criminal will pose as a made-up charity you’ve never heard of, although scammers may also pretend to represent a legitimate, well-known charity. If they seem pushy and ask for an immediate donation, it’s best to hang up or walk away.

How to spot Charity Fraud:

Source: Federal Trade Commission Consumer Information

What to do if you witness Charity Fraud:

- Before making any charitable donation, verify the organization at Give.org, the Better Business Bureau’s Wise Giving Alliance Website.

- If you find the charity is legitimate, give the funds directly via the organization's official website or mailing address (not to the person who contacted you).

- If someone wants donations in cash, gift card or by wire - don't do it. Scammers frequently use these payment forms.

- Keep a record of all your donations (which you should be doing anyway for tax purposes).

- If you are approached on the street and asked to give a charitable donation, ask the person for more documentation about the charity, or the organization's tax-exempt (EID) number, along with these questions: 1) How is my money being used? 2) Where are you located? 3) How much of my money is going directly to the program?

4. Christmas Phishing Scams and Gift Card Phishing

This holiday season, be on the lookout for common Christmas phishing scams. Some scammers will deceive victims by offering free gift cards or other “too-good-to-be-true” offers through malicious phishing emails. These emails try to entice you to click on links that promise free gift cards, but don't fall for it - just one click can put your personal information at risk.

What is phishing?

Phishing is a form of cyber attack that entices users into clicking on a link that will compromise private data. These links can download malicious software onto your computer or lead you to phony websites that might ask for personal information, credit card details or login credentials for your bank account. Phishing emails can include enticing offers, but these fraudulent emails are also often disguised as important requests from your boss or a government agency.

Here's an example of a Gift Card Phishing Email:

What to do if you suspect a phishing email:

- Always check the actual sender address (name@example.com) on each email you receive. If that address doesn't match up with the sender's name, or the company they claim to represent, delete the email right away.

- Never click on links in emails, unless you can verify that it is from a trusted sender and you have hovered or previewed the URL where the link will take you.

- Remain vigilant during the holiday season when you might really want that extra cash seemingly promised by Christmas phishing scams.

- Learn more about email phishing threats in another one of our blogs.

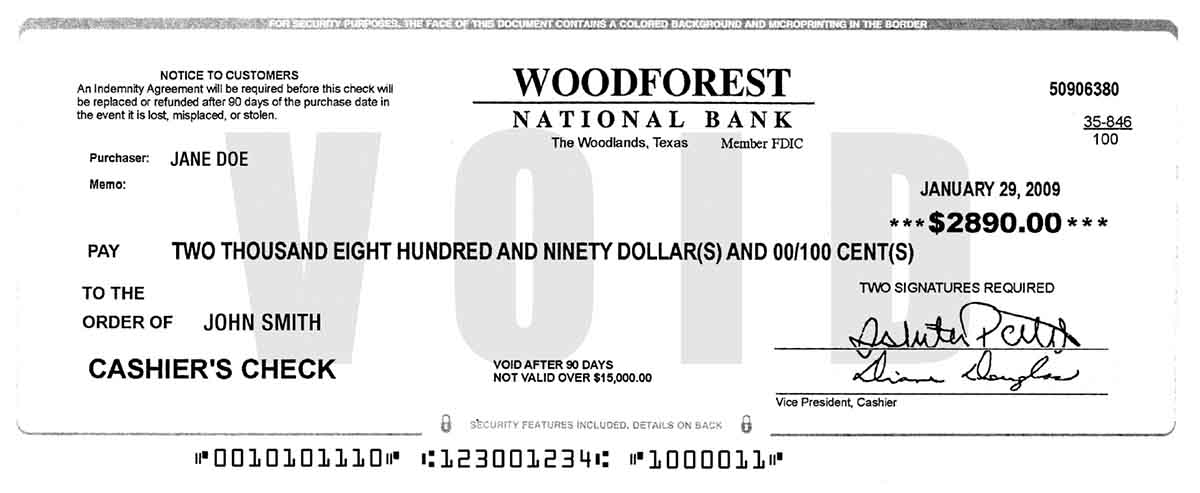

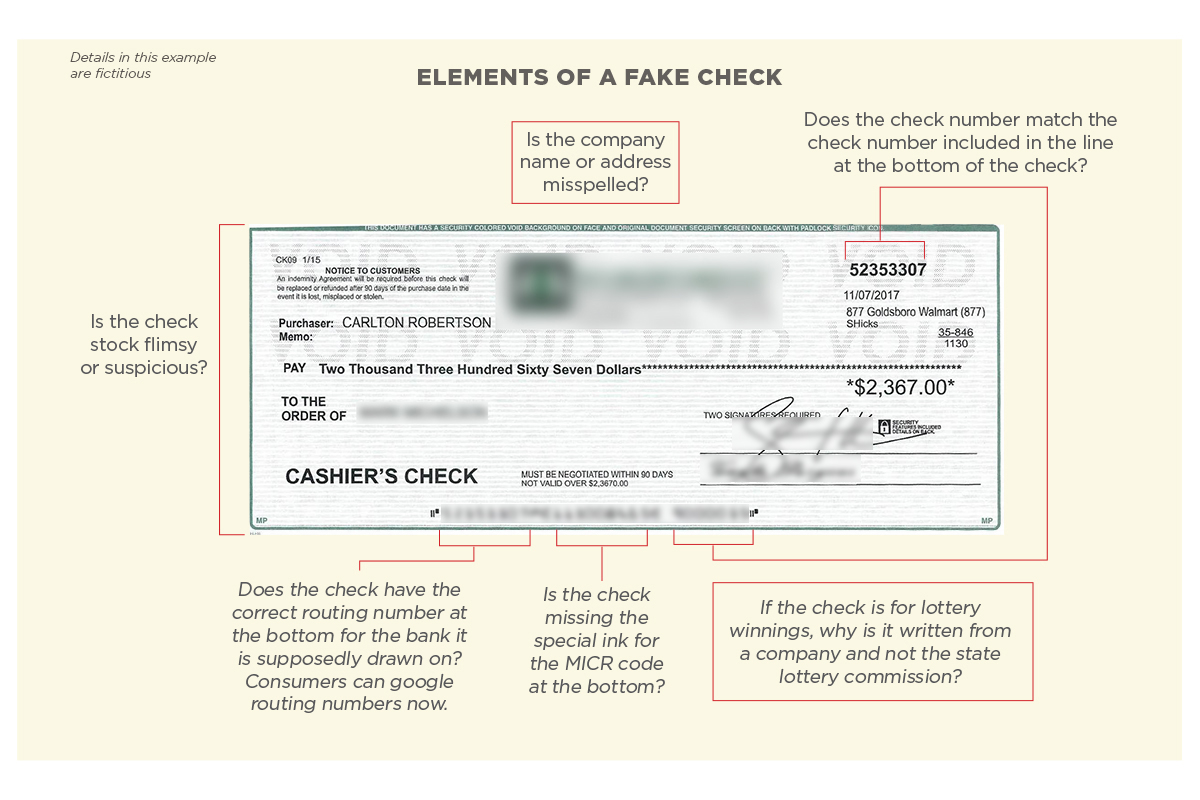

5. Fake Check Scams

In this scam, the criminal will devise a scenario that entitles you to receive a check, such as claiming you won a prize or overpaying you for something you sold online. But when you receive the check, you are asked to send back a small portion of the check (explained as “back taxes” or “fees”). Even false checks initially clear sometimes, only to be found as fraudulent a few days later. And when they are, you will be on the hook for paying the money back (in addition to losing any money you sent to the criminal via wire or email).

Here's an example of a Fake Check:

Download Example (PDF)

Source: Better Business Bureau

What to do if you suspect a fake check:

- Never send money back to someone who sends you a check, especially if it's unsolicited. Ignore the offer or report it to the FTC.

- Selling online? Never accept a check for more than your selling price.

- When in doubt, contact us at Security National Bank and our professionals can help verify checks or notify the authorities of suspected check fraud.

With any offers you receive, especially during the holiday season, it's best to keep this in mind: If it seems too good to be true, it probably is. Be aware of holiday scams, and keep an eye out for your friends and family too. If you aren't sure whether or not an offer is legitimate, talk to friends and families to see what they think, research the offer and the company making the offer, or contact us at Security National Bank and we can help.

Want more fraud prevention tips? Sign up for the monthly newsletter from Security National Bank.