What Was the Biggest Scam of 2023? You May be Surprised

February 26, 2024

By Michelle Hacker

By Michelle Hacker

Digital Services OfficerEach day, thousands of people file reports about scams they've detected with the Federal Trade Commission (FTC). Each year, the FTC compiles this information into a fraud and scam data book highlighting the most common scams. This resource helps the public recognize and steer clear of those threats.

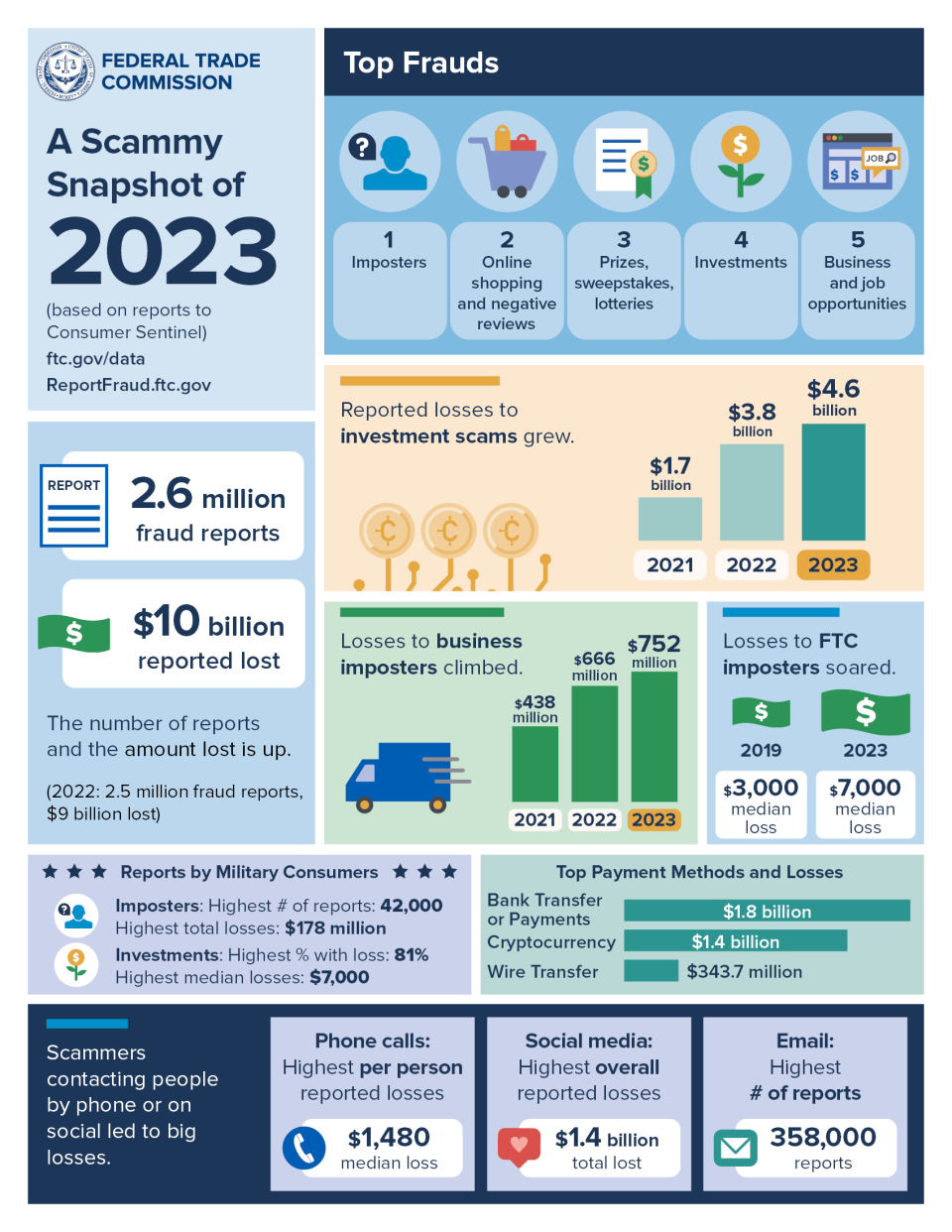

The year 2023 saw a significant surge in fraud losses, surpassing $10 billion, fueled by a rise in web and social media-based scams. This was a $1 billion increase from the previous year. While the number of reports remained steady at 2.6 million, one in four reporting individuals still fell victim, with a median loss of $500.

Which scams were the most prevalent? Let's take a look.

Top Scamming Method: Phishing Emails

Email was easily the No. 1 contact method for scammers this year, with more than 358,000 reports of phishing scams showing up in people's inboxes. Many of these instances involved scammers pretending to be a business or government agency to steal money.

Security Tip: Remember, even during tax season, the IRS will never email you asking for money or personal information.

Rising Channel: Social Media Scams

While email scams were the most common channel, and phone scams led to higher average losses per person, social media scams registered the highest total monetary losses at $1.4 billion -- a $250 million rise from 2022. Social media scams can manifest in various forms including fake Marketplace postings, puppy scams, online dating scams and even charity scams.

Security Tip: Never pay for something in advance on Facebook Marketplace -- even if it's just a "down payment" -- until you have actually received the item.

Highest Loss Category: Imposter Scams

The top category culprit in 2023 was imposter scams, causing $2.7 billion in losses. These scams involve impersonators posing as trusted entities like banks, government officials, relatives, businesses, or even technical support. Scammers have been known to send emails (see above) and even to spoof official phone numbers of organizations you know and trust.

Security Tip: Remember, your Bank will never call or text you out of the blue and ask for your personal information. If someone does, it's a scam.

Largest Surge: Investment Scams

Though less common, investment scams saw a surge in losses, with victims losing a median of $7.7K, compared to $5K in 2022. Investment scams spanned from fictitious opportunities in day trading, gold, gems, and art to offering deceptive investment advice.

Security Tip: When it comes to investments, stick to a trusted fiduciary -- that is a person or organization, like Security National Wealth Management, that is legally and ethically bound to act in a client's best interests.

Highest Scam Payment Method: Bank Transfers

Scammers favored to be paid through bank transfers and payments ($1.86 billion), closely followed by cryptocurrency ($1.41 billion). However, the growing popularity of online payment apps (like Venmo and Zelle) also comes with a rise in scams targeting their users. And don't forget, gift card scams are also on the rise!

Security Tip: Sending money through a payment app is just like handing someone actual cash. Only send money to people you know, and use a trusted payment platform (like the SNB Mobile App).

Most Targeted Age Groups: Young & Older Adults

Young adults (20-29) reported more frequent losses this year, but older adults (70+) endured the highest individual losses. The financial exploitation of the elderly happens more than you think. And unfortunately, it's usually caused by people the victim is closest with.

Security Tip: Knowing what to do if you suspect elder financial abuse may help save you and your loved one from unnecessary stress.

Have you spotted a scam?

If you spot a scam, report it to the FTC online at www.FTC.gov or by phone at 1-877-FTC-HELP. If you have already shared your personal information with someone you don't know, visit www.ftc.gov/IDTheft to consider your next steps. For more information on latest scams and how you can protect yourself, subscribe to our newsletter.