How to Make Sure You Get Your Coronavirus Stimulus Money

April 14, 2020

By Chris Jackson

By Chris Jackson

Assistant V.P. of Retail ServicesThe IRS has started to deposit Economic Impact Payments — also known as “coronavirus stimulus checks”— into taxpayers' bank accounts.

Nearly 90 million Americans have already received their $1,200 economic impact payment, starting with those who receive their tax refunds by direct deposit. If you haven't received your stimulus money yet, don't worry — you likely will soon. For those expecting to receive checks or prepaid debit cards by mail, the process may take a few weeks longer. In any case, we'll take you through the right steps to make sure you qualify for a payment, and how to get it into your account.

Who is eligible for a coronavirus stimulus payment?

If you filed a tax return in 2018 or 2019, and meet the income thresholds below, you should receive a payment. That's it. Most taxpayers just need to wait for the deposit to drop in their account or the check to arrive in the mail — depending on the way they usually receive their tax refund.

If you didn't make enough money to file taxes, but still received government benefits (social security, railroad retirement, supplemental security income, disability or veterans' benefits, etc.), you will also receive a payment — but you'll want to make sure the IRS has your most updated information. More on that below.

How much will your payment be?

- You will receive $1,200 if you're a taxpayer with an adjusted gross income (AGI) of $75,000 or less per year.

- You will receive $2,400 if you're a married couple that earns less than $150,000 per year.

- Each qualifying child will get you an extra $500.

If your income is higher than those amounts, the payout starts to decline the more you make. But you will still receive some sort of payment as long as you are:

- Any single person (or married filing separately) who makes less than $99,000

- Any head of household who makes less than $136,500

- Any married couple making less than $198,000 will still qualify for some sort of payment

Find the exact amount on the IRS Economic Impact Payments information page.

Here's how to make sure you get your money:

Most taxpayers will not need to take any action to receive their payment. As long as you filed a tax return for 2018 or 2019, the government will deposit the money into your bank account.

If you filed your taxes but didn’t give the IRS your direct deposit information, the IRS will instead send you a physical check (or prepaid debit card) in the mail. See the status of your check by using the “Get My Payment” portal on the IRS Website (you can also switch to direct deposit here if the IRS hasn’t sent your check yet).

What if you didn't file a tax return?

If you didn't file a tax return for 2018 or 2019, go to the "non-filer" section of the IRS Web Portal to make sure the government knows where to send your money.

It's important that you only use the legitimate IRS portal to send your personal information. Submitting this information on the wrong site will put your identity at risk.

How will you know when your payment arrives?

If you're a Security National Bank customer with online banking, you can set an alert for when the deposit gets placed into your account.

How to set an alert on your account (click to expand)

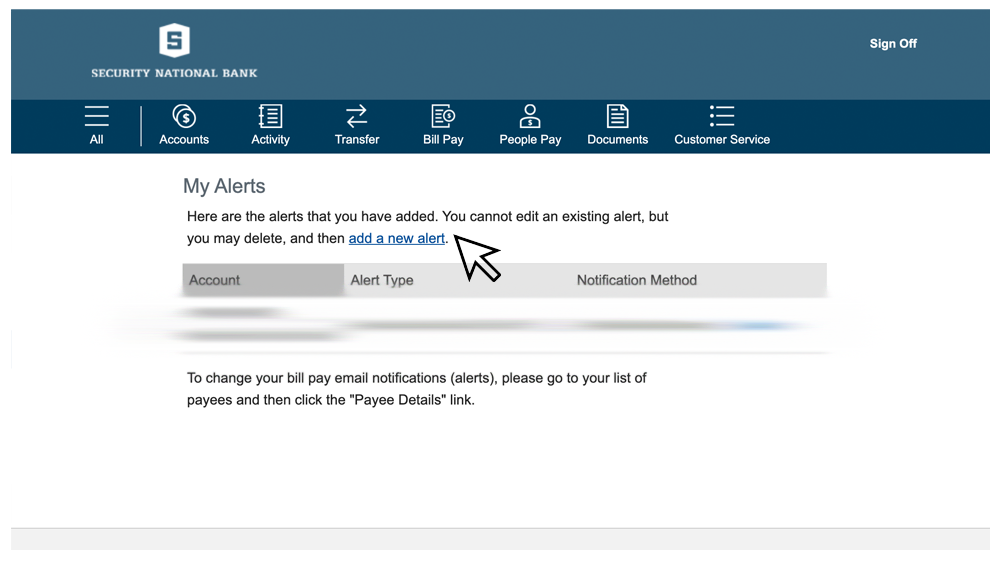

A) Log in to Online Banking and navigate to:

• Customer Service > My Alerts

(or)

• All > Support > View My Alerts.

B) Click Add a New Alert.

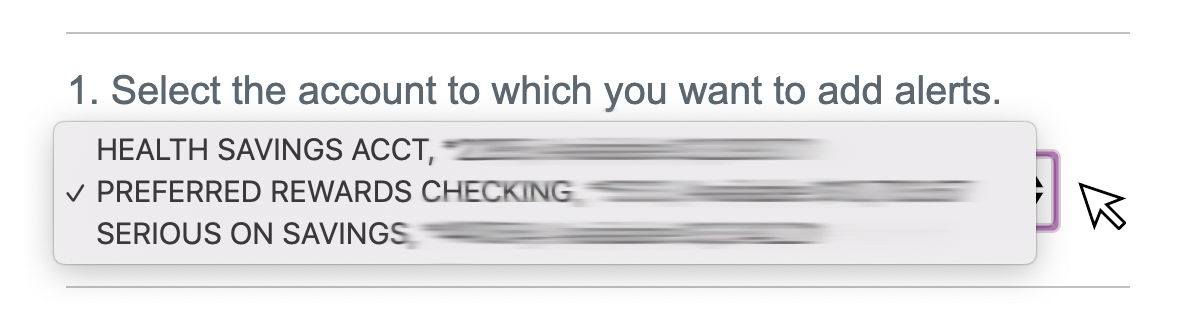

C) On the “Add Alert” page: Under Step 1, select the right account in the dropdown menu.

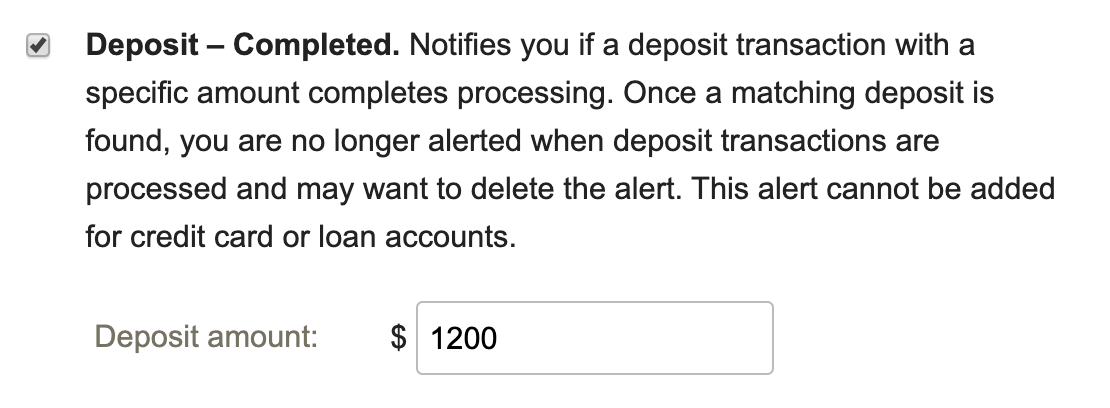

D) Under Step 2, click the “Deposit — Completed” checkbox and enter the expected Deposit amount that you plan to receive from the IRS (for example, $1,200. If you’re not sure of the amount, refer to the IRS Economic Impact Payments information page).

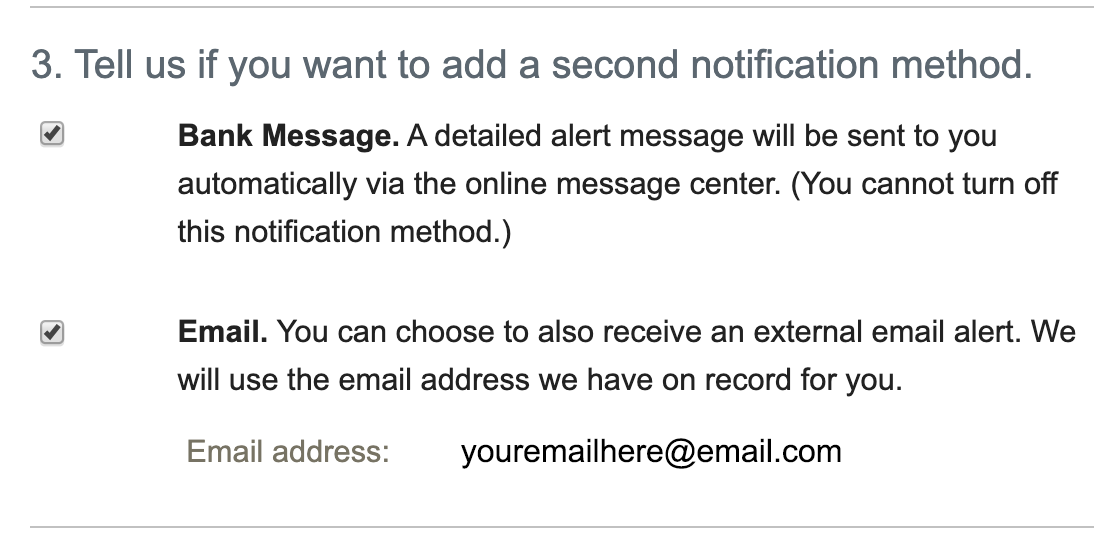

E) Under Step 3, click the “Email” checkbox. Enter the email address to which you’d like to send the alert.

F) Click Submit and watch your inbox for confirmation that you’ve received the check.

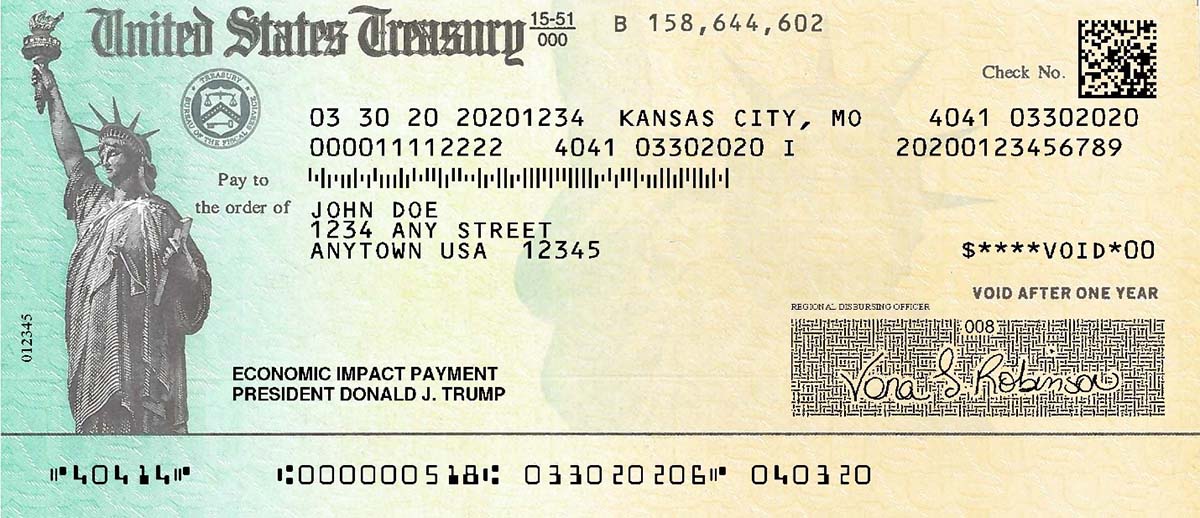

If you receive a coronavirus stimulus check in the mail, it will look just like a normal tax refund check (see the example) — except that on the memo line it will say “Economic Impact Payment” with President Trump’s name:

Check Front (example):

Check back (example):

SNB customers can even deposit the check from home using the SNB Mobile App.

You want your stimulus check. So do scammers.

Be on the lookout for scam artists posing as the IRS and using the economic impact payments as cover. Remember: the IRS will never call, text, email or contact you asking for personal information. Anyone who claims otherwise is a scammer.

Read our other blogs for more information on coronavirus scams and phishing scams for more information on how to protect yourself.

The IRS does plan to mail a letter within 15 days after sending your payment. The letter will contain information on the payment and how to report if you failed to receive it.

Stay up-to-date

We want to provide solutions that matter, when you need them most. Keep up with the latest updates on our Coronavirus Information Page.